Moneyball for Retail

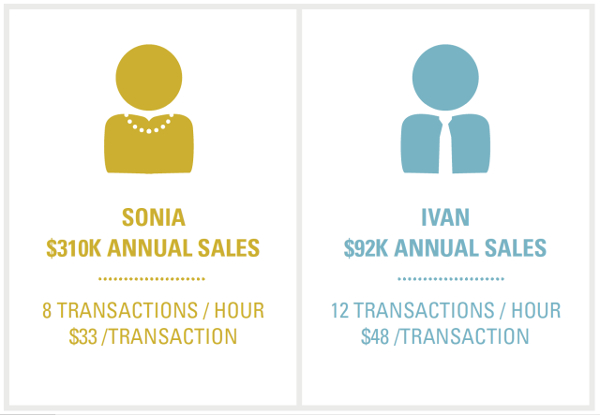

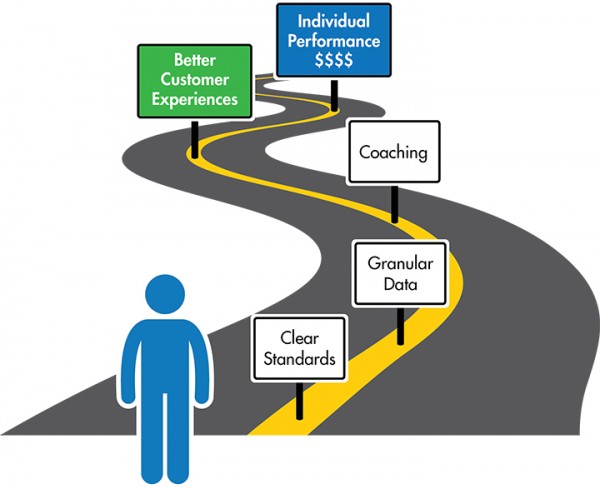

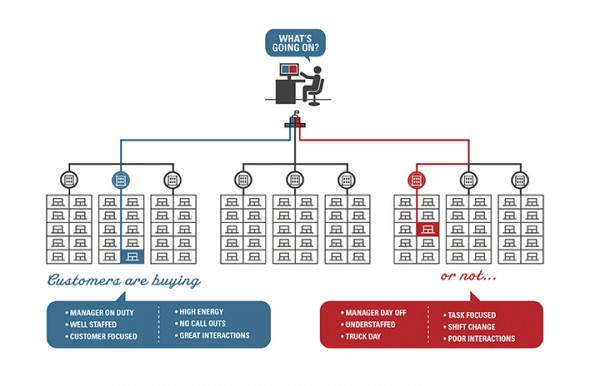

There’s a new way to grow profits and hit it out of the park with consumers, employees and shareholders. It’s “Moneyball for Retail” – finding market inefficiencies to gain a competitive advantage. In Major League Baseball, team owners want to […]

Moneyball for Retail Read More »