Levi Strauss: A Brand Resurrection

Jasmine Glasheen

May 7, 2024

Levi's resurrects its brand by adapting to Gen Z's trends - customization, sustainability. Despite layoffs, it expands into new markets, emphasizing transparency.

The Latest

Exploring the Ozempic Economy

Sarah Holbrook

May 6, 2024

In exploring the Ozempic Economy, whispers in early 2023 circulated in rarefied circles about the power of Ozempic, Wegovy, Mounjaro, ...

Inditex and Mango Look to the U.S. for Growth

Mark Faithfull

May 2, 2024

Inditex and Mango are surging into the U.S. market. From new investments to exciting collaborations, there is no stopping these Spanish brands.

What the Failure of Pirch Says About Experiential Retailing

Warren Shoulberg

May 1, 2024

The failure of Pirch prompts industry introspection. Costly leases and limited merchandise hurt sales. A cautionary tale: trendy retail without substance.

Experience

Postcards from Paris: Reflections on World Retail Congress 2024

Deborah Patton

April 29, 2024

World Retail Congress 2024 convened leaders addressing AI's impact, geopolitical challenges, and the pivotal shift towards customer-centric strategies.

Shoptalk 2024: Tech Talk in a Retail Agora

Deborah Patton

April 18, 2024

Shoptalk 2024 explored retail's future with tech innovations like Gen AI and AI-driven personalization. Unified commerce and customer-centricity were key.

Liquid Death Sparkling Water is a Billion Dollar Elixir

Arick Wierson

April 16, 2024

Liquid Death: From water to billion-dollar brand. Gen Z allure, eco-packaging, and rebellious marketing redefine beverage industry norms.

Get the Daily Report

Subscribe to The Robin Report and get our latest retail insights delivered right to your inbox.

We will never send you spam or share your info.

Opinion

Micro-dosing to Malnutrition: A Diet Culture Shift

Explore the latest diet culture shift and its impact on health and the economy. Uncover future food industry prospects and regulatory urgencies.

Kate Newlin

April 30, 2024

True Crime Retail Podcast

There was a time we could still envision when going to the mall used to be a joyous activity. Even an aspirational one. Even a ...

Kate Newlin

February 13, 2024

New Episodes Weekly

The Retail Unwrapped Podcast

Retail insights on-the-go. Available on your favorite podcast platforms

From Our Partners

Postcards from Paris: Reflections on World Retail Congress 2024

Deborah Patton

April 29, 2024

World Retail Congress 2024 convened leaders addressing AI's impact, geopolitical challenges, and the pivotal shift towards customer-centric strategies.

Shoptalk 2024: Tech Talk in a Retail Agora

Deborah Patton

April 18, 2024

Shoptalk 2024 explored retail's future with tech innovations like Gen AI and AI-driven personalization. Unified commerce and customer-centricity were key.

Technology

A Retail Vendor Portal Built on Trust

Jay Hakami

April 4, 2024

If you visualize the future, chances are you don’t see it as a triangle. But look again. Think of the ...

Behind the Scenes with Scayle Super-Entrepreneur Tarek Müller

Deborah Patton

March 6, 2024

What does it take to make a startup endure? Success in the global digital marketplace does not come easily or ...

7 Ways Retailers Are Doing SEO Dead Wrong

Jasmine Glasheen

February 26, 2024

The last five years of accelerated advancements in SEO marketing haven’t given retailers and brands time to even catch their ...

Management

The Saga of Gap’s Decline and Fall

Marie Driscoll

April 22, 2024

Zac Posen's arrival at Gap sparks hope for a turnaround, echoing legendary fashion partnerships. Can the Dickson-Posen duo impact Gap's Decline?

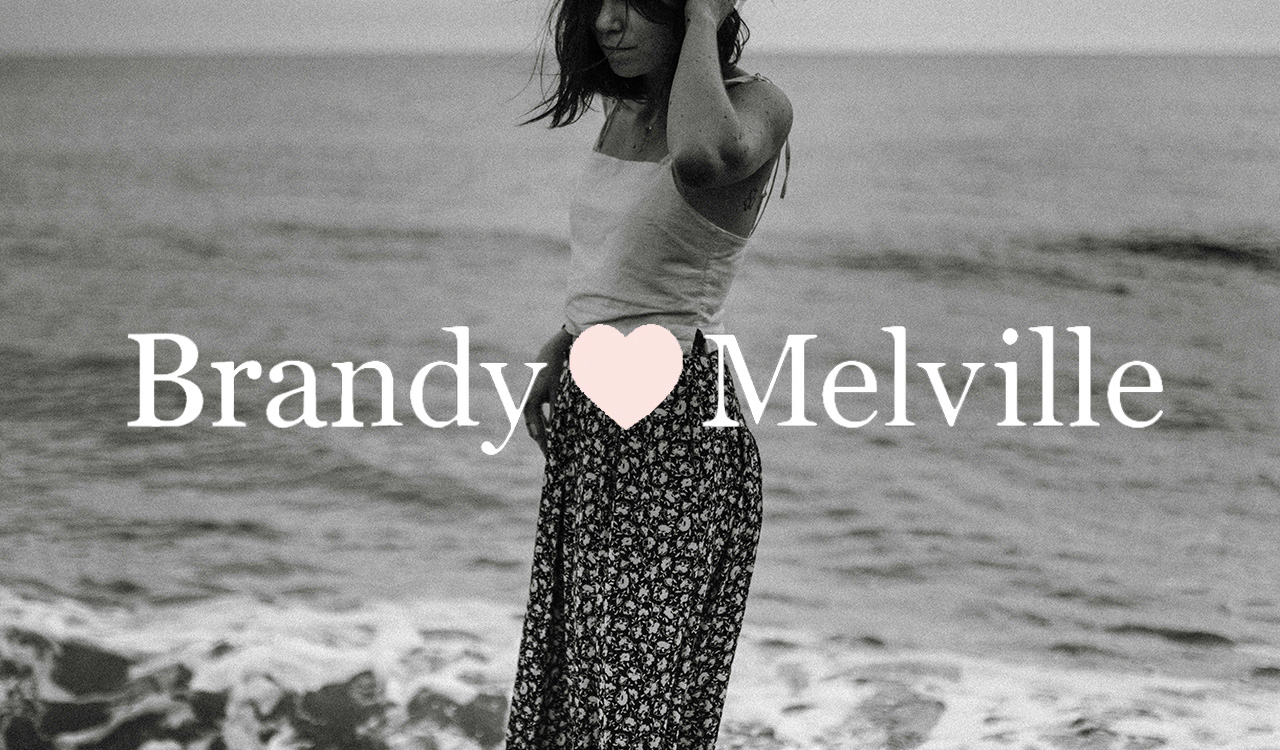

Brandy Melville, or Hellville?

Robin Lewis

April 15, 2024

Brandy Melville CEO enforces narrow beauty standards, amid controversies. Sales soar, revealing dark side of fast fashion.

Operations

What the Failure of Pirch Says About Experiential Retailing

Warren Shoulberg

May 1, 2024

The failure of Pirch prompts industry introspection. Costly leases and limited merchandise hurt sales. A cautionary tale: trendy retail without substance.

The Decline and Fall of 99 Cents Only Stores

Phil Lempert

April 25, 2024

David Gold's 99 Cents Only Stores rise and fall illustrates retail's evolution, influenced by consumer behavior, economy, and competition.

The Fallout: Retailers and CPG Price Gouging

Phil Lempert

April 17, 2024

FTC report exposes price gouging in pandemic. Kroger, Albertsons face merger scrutiny. Urgent need for transparency, fair pricing, and trust rebuilding.