In exploring the Ozempic Economy, whispers in early 2023 circulated in rarefied circles about the power of Ozempic, Wegovy, Mounjaro, and other GLP-1 diabetes medications for stealthy and remarkably effective weight loss. By November 2023, the buzz on this family of weight loss drugs was a cacophony as implication analyses began in earnest. Sheila Kahyaoglu, a Jefferies Financial analyst forecasted that United Airlines could save $80 million a year in jet fuel costs as planes occupied by lighter passengers will require less fuel. JP Morgan Research speculated there would be 30 million active GLP-1 users in the United States by 2030, and McKinsey included drug-assisted weight loss medications in the consultancy’s $1.8 trillion, 2024 estimate of the global wellness market.

Vitality Retail is an aggregation of individual retail categories, Beauty, Fitness-Wellness, Pharmacy, including healthcare services, and some elements of Grocery. We envision a multifaceted collection of goods and services encompassing Medical Spas staffed with doctors who can prescribe GLP-1 medications, administer injectables fillers, and other beauty and health treatments, fitness centers with retail outlets, nutrition services and prescriptive groceries, and cosmetic and beauty products to maximize the benefits of weight loss.

Ozempic Economy

As awareness has grown, the term “Ozempic Economy” has emerged. In an October episode of Vox Media’s Pivot podcast, pundit and NYU marketing professor Scott Galloway enthusiastically hyped the economic impact of this class of medications calling it “The biggest business story of the year… when all of a sudden 100 million people are eating and drinking less…there will be a lot of winners that we can’t even project. Everyone’s talking about AI, and it’s going to grab the most headlines, but over the next five years the greatest shifts in market capitalization are going to happen because of the Ozempic Economy, whatever you want to call it, the obesity economy, that’s about to be disrupted… When it goes away, you’re going to see trillions of dollars of market capitalization reallocated and reshuffled.”

Alternative Impact

The retail press has aggressively covered the Ozempic frenzy. The bulk of the coverage and commentary landed in the obvious place, grocery. Food and beverage purchasing patterns are an easily quantifiable signal of changing global eating habits. We are taking a different tack in this article, zooming out from the obvious in search of alternative potentialities and opportunities that may emerge from this driver of change.

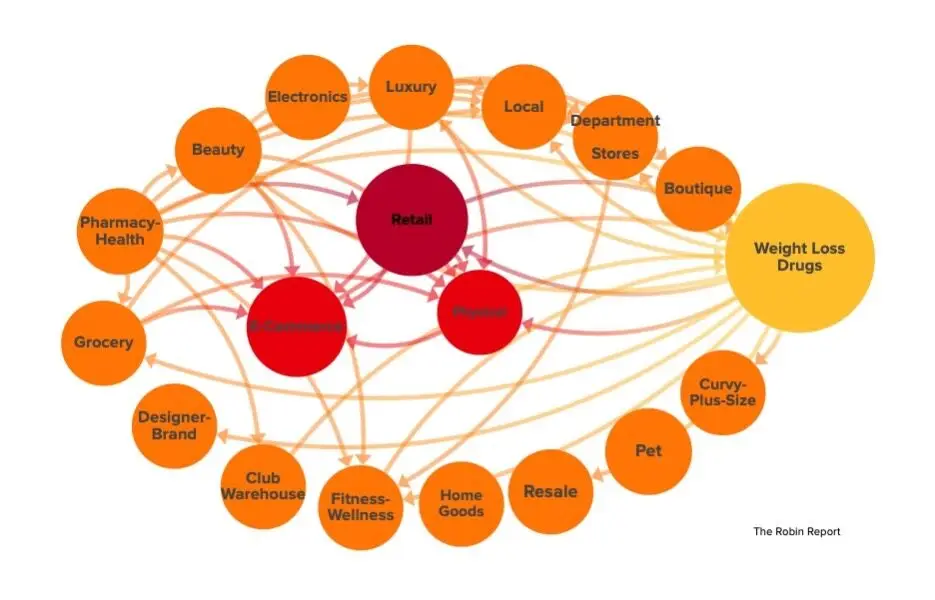

The Analysis

For those who want to just cut to the chase, hang on for our analysis. We’ve concluded that there are significant opportunities for retail in the Ozempic Economy. That said, we are going to take you on a journey. We have approached this potential economic sea change systematically.

We analyzed the retail industry and broke it down into physical and online commerce. Next, we generated a comprehensive list of retail categories to evaluate the impact of anti-obesity medications (AOM). We also cycled through the lens of STEEP categories, Social, Technology, Economic, Environment, and Political to avoid any blind spots. From there, we researched the inherent uncertainties challenging the hypothesis that Ozempic and other weight loss drugs will have a significant impact on the overall economy, and retail accordingly. The process is the result of fact-based, critical thinking.

Uncertainties

Starting with the uncertainties there is a blend of social, economic, and political forces both weighing against and supporting the widespread adoption of AOMs. Pressures include complaints about unpleasant side effects, but the leading counterforce is cost. Currently, in the United States, the list price (without insurance) of Novo Nordisk’s medication Ozempic is $935.77 a month. At this price, a widescale uptick in users would seem farfetched, but in March, the political winds shifted.

Medicare now covers GLP-1 medications for diabetes and other approved applications. Medicaid offers coverage, although some states limit access. Private insurers are revising coverage policies as well. Other headwinds include pushback from the body-positive movement, but signals indicate that this social trend is losing strength. Vogue reports that plus-size representation made up just 0.8 percent of the Autumn/Winter ‘24 looks in the seasonal shows. Technology tailwinds include progress in developing AODs in pill form, currently, the popular weight loss drugs are only available as injections.

Despite the uncertainties, prescription numbers reflect unmitigated momentum in usage. CNN reports a 25 percent increase in prescriptions for Ozempic, Wegovy, and Mounjaro, as well as increases in alternative weight loss medications in calendar year 2023. Even if the adoption rate were to slow, a slimmer future world is a plausible scenario.

Impacts and Opportunities

We also weighed potential impacts and opportunities on leading retail categories. Admittedly, we did not explore every facet of retail and our key sectors include:

- Electronics

- Pets

- Home Goods

- Local

- Luxury

- Department Stores

- Boutiques

- Resale

- Curvy/Plus-Size

- Fitness/Wellness

- Clubs/Warehouse

- Designer/Brand

- Grocery

- Pharmacy/Health

- Beauty

From our list of 15 retail categories, 12 will benefit from the wide adoption of AOMs. Pet (at least for now), Electronics, and Home Goods have no clear connection to the key driver. Most of the apparel retail categories listed have only a tangential connection to the Ozempic Economy.

However, we anticipate that the Resale and Curvy-Plus-size categories will experience elevated activity. BOF quotes Deutsche Bank analyst Adam Cochrane who describes apparel retailers benefitting from an emergent wardrobe replacement cycle as consumers resize. He called out the fitness brands Adidas and Puma along with large apparel retailers Inditex, H&M, and Primark as beneficiaries. Describing the potential impact, Cochrane said that the shift “could provide a structural tailwind for the apparel industry that hasn’t been seen for some time.”

As mentioned, grocery will be greatly impacted. In November 2023, WSJ reported “Sales of Ozempic and Wegovy, developed by Novo Nordisk, and Eli Lilly’s Mounjaro, have added $339 billion in market cap this year, a sum greater than the value of all but 18 companies in the S&P 500. Those gains are taking a bite out of other sectors. The S&P Food & Beverage Select Industry Index has declined 12 percent over the past three months. Shares of Kraft Heinz are down 13 percent over the same period. Hershey is down 19 percent, while Coca-Cola and PepsiCo have shed 9 percent and 13 percent, respectively.” In October, Walmart U.S. chief executive John Furner said that the retail giant had seen “a slight change” in food purchasing habits of people taking Ozempic and other weight loss drugs compared to people who aren’t.

- Pharmacy and Clubs/Warehouse categories will benefit from increased prescription activity.

- Fitness and Wellness brands have already responded to the trend. WWD Beauty Reports that Equinox launched a fitness program specifically for members taking weight loss drugs. In a statement, the company noted customer’s concern over muscle degradation, a common side effect of AODs.

- Beauty brands and Med Spas are responding to “Ozempic Face,” the gaunt, sagging, and prematurely aged appearance in facial skin that is often a second-order effect of the weight loss drugs. BOF reports that searches for bronzing products, which create more of a healthy all-over glow, are up 33 percent since last year while med spas are experiencing increased demand for Sculptra and other volumizing treatments.

Introducing Vitality Retail

What is emerging as we trace the market connections is a new category, Vitality Retail (or Life Positive Retail). Vitality Retail is an aggregation of individual retail categories including, Beauty, Fitness-Wellness, and Pharmacy, as well as healthcare services, and some elements of Grocery. We predict a multifaceted collection of goods and services encompassing Medical Spas staffed with doctors who can prescribe GLP-1 medications, administer injectables fillers, and other beauty and health treatments, fitness centers with retail outlets, nutrition services and prescriptive groceries, and cosmetic and beauty products to maximize the benefits of weight loss.

That’s the good news. The less-good news is that the gains will likely fall to the largest retailers who are best positioned to consolidate assets either through restructuring, innovation, or acquisition to dominate this novel retail channel. We already see signs of this retail future in the healthcare ambitions of Amazon, Walmart, and CVS. Vitality Grocery would be a tweak on existing supply chains and delivery practices of the mega-retail brands. Fitness-Wellness is more of a stretch and might be best served through an acquisition. A brand like Peloton, a distressed asset with strong brand equity could grow serving a broad audience, including the Ozempic Economy consumer. We see beauty, footwear, and all forms of fitness and sportswear wrapped into the Vitality Retail panoply.

The drivers behind the demand for weight loss medications are complex encompassing health, psychological and emotional. We’re not ignoring them, nor any of the negative consequences of these medications. We are not experts in the many layers and complexity of the issue of wellbeing and vanity.

We are casting a wide future lens based on the retail industry to explore the potential upside of a powerful trend. We encourage you to do the same as you look to your business’s future identifying the possible impacts of the Ozempic Economy.