With all due respect, after two decades of my tracking Eddie Lampert’s brilliant financially engineered demise of Sears and Kmart, while he personally pocketed a few billion dollars of “unlocked value” along the way, I would have loved to deliver that eulogy to him as my final word.

However, a headline in a recent Retail Dive article referred to the fact that the Supreme Court rejected an attempt from Lampert and his other lenders to wring millions more from what’s left of the former retail giant. This followed three other courts rejecting the scheme. Indeed, the deed is done, and fodder for more articles from me is over. Although, it may be worthy of a book. Stay tuned.

Lampert once blogged that Sears is “fighting like hell” and making progress. I said, anybody who believes any of this is living on another planet. We all know it’s a shell game. We know his real intent was to stick another life support tube into Sears’ slowly dying body to keep it alive long enough for another round of squeezing cash out of it.

Sears officially filed for Chapter 11 bankruptcy in October 2018. That it took four more years and three appeals to result with a “hard stop” by the Supreme Court would once again indicate the financial prowess of Eddie Lampert as he argued the value of collateral (largely inventory) with lawyers. One could say this was Eddie’s final act of “unlocking value” for himself.

Just Before the Fall

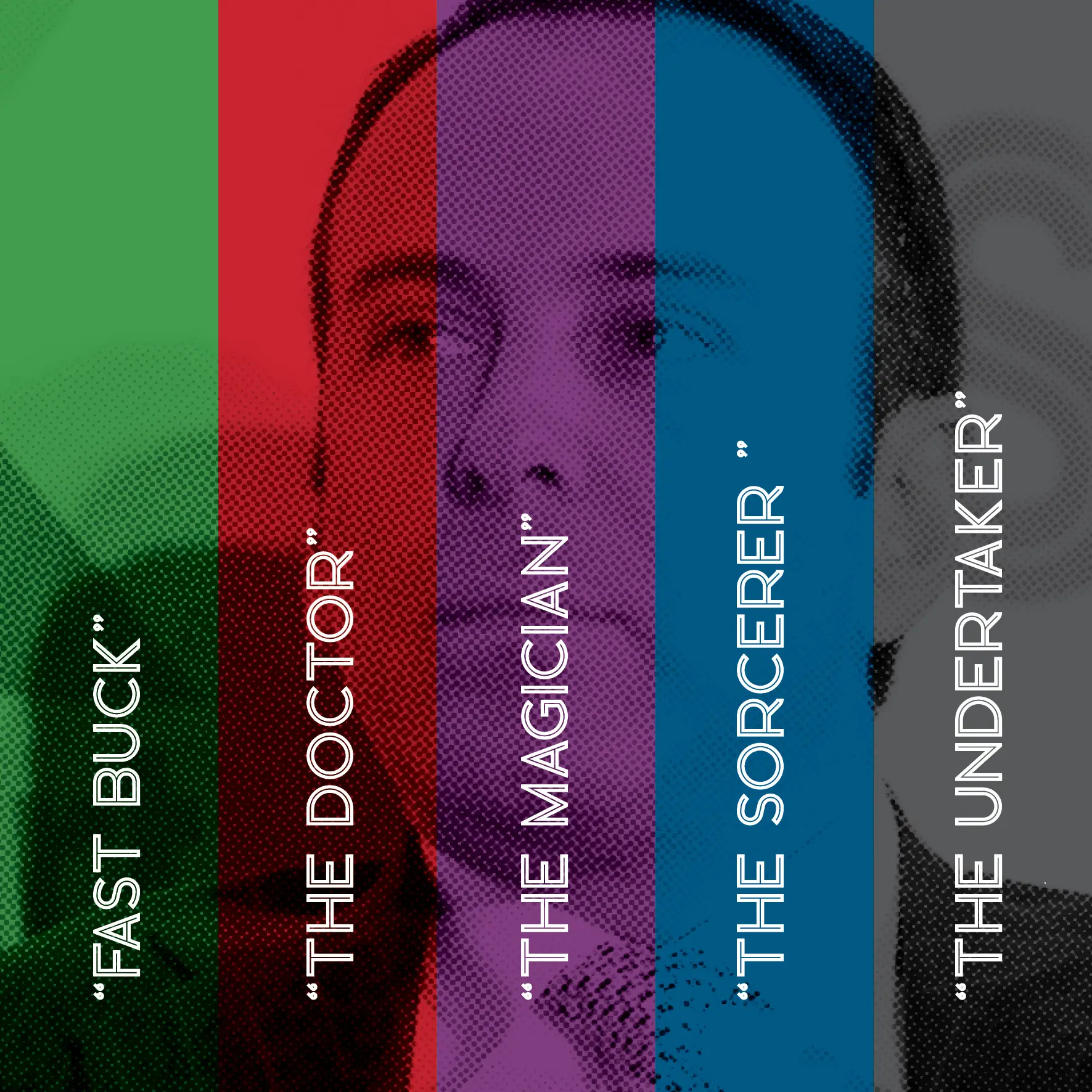

In May 2018 I said I found it hard to believe that “Fast Buck” Eddie (one nickname, among others I have given to him) actually believed that people in the retail industry and Wall Street thought that he was going to rescue the business of Sears. Yes Eddie, that pesky word “believe” is finally catching up to you. For all these years since putting the two “Titanics” together (Sears and Kmart), you were Eddie “The Magician” Lampert. From day one (and you are no Jeff Bezos), you had everybody believing you were going to return these two iconic American brands to their once storied greatness. Well, not everybody. And certainly not me. In fact, from day one I said there was no way you could pull it off. I even suggested that I believed this was going to be a brilliant financial engineering strategy to manage the businesses down over a long period of time, separate the assets, and unlock their greater individual values. Thus, you and ESL (his bespoke investment firm) could pocket a great deal of money as the Titanics finally sank below the horizon.

So, at the time five months prior to filing in October 2018, Lampert was still trying to convince Wall Street and the industry that they should believe his latest vision going forward. I said “Eddie, look in the rearview mirror to remind you about the year-over-year steady decline in revenues from day one. Honestly, you make your vision forward an oxymoron.”

Blurred Vision

Eddie envisioned Sears future as an asset-light business, focusing on ecommerce memberships in the Shop Your Way program. He blogged that Sears is “fighting like hell” and making progress. I said, anybody who believes any of this is living on another planet. We all know it’s a shell game. We know your real intent is to stick another life support tube into Sears’ slowly dying body to keep it alive long enough for another round of squeezing cash out of it. Hey! You received kudos, including mine, for your brilliant financial engineering to manage a slow death, while identifying and securitizing the most valuable assets to eventually lease or sell, including the iconic brands and real estate. In terms of the real estate value, much of it was placed in a REIT that you then charged back to the dying retail business for rent while you methodically sold off the properties and pocketed a good share of the proceeds.

The Final Act

And then, Eddie “The Doctor’s” latest injection of a hallucinogenic life-saving drug was his offer to the ESL board, and himself as Chairman, to acquire what was left of certain assets. Once again it would be a “buy from Peter to pay Paul” transaction. Except, Peter and Paul were both Eddie.

As majority owner of Sears and its assets, Eddie “The Magician” (his alter-ego) seemed to be conducting a sleight of hand trick. He explored the sale of Kenmore, the Sears Home Improvement Products business, as well as the Parts Direct component of the Sears Home Services division. And here was the magic: he shopped them around and was getting no takers because the price tags were considered astronomical by potential buyers, so very few bids were received. So, if you looked closely enough and didn’t get confused by all the abracadabra stuff, maybe the wizard (a step up from a magician) intentionally threw a price out to the market that he knew would not snag any takers.

Why would he do such a thing? Ah-ha! It was a setup. Remember Peter and Paul were both Eddie.

Stick with me here. So, Eddie playing Peter (who was in actuality Sears and ESL Holdings) offered to acquire those Sears assets he couldn’t sell to anybody else. Paul (who also happens to be Eddie and ESL Holdings) is the seller. Was all this black magic? Did you even care which rabbit was pulled from which hat?

Don’t even try to figure out what the assets were worth either to Peter or Paul. They were worth whatever Eddie Peter and Eddie Paul said they were worth. Oh, and while the magician was pulling all of this off, and when the “now you see it, now you don’t” moment arrived, he pulled yet another rabbit out of his hat: the real estate rabbit. Again, Peter could buy some more real estate from himself and lease it out to himself, AKA Paul.

If you’re still following all this, as the financial magician, Eddie the Sorcerer dazzled us and put an enchantment spell on us. His sleight of hand moves were so quick and seemingly so complicated that we would gasp at the end of his act because we couldn’t keep up with all the rabbits he pulled out of a hat, figure out how a dozen doves flew out of a bag or how one scarf turned into fifty…or whatever.

So, logically you would say, come on, give us the numbers. Forget it. That was the central part of his act. When he threw all those numbers around in such a complicated, magical process, borrowing from Peter to pay Paul, he completely confused everyone. Most of his accounting magic left even the great financial minds and analysts baffled.

So, at the end of this long journey I’ve taken with Fast/Doctor/Magician/Sorcerer Eddie, all you need to take away is that Sears is dead. Not surprisingly, Eddie “The Undertaker” Lampert financially engineered Sears down into the briny deep. While he did this, he unlocked the value of most of its assets in such magical ways that a good chunk of it flowed right back into his pocket. Well, we won’t have Eddie to kick around anymore. Or will we?