In the hierarchy of what next gens are seeking from the vast sea of beauty products out there, the top three Gen Z beauty preference attributes shake out in this order: efficacy, affordable pricing, and rock-solid brand values.

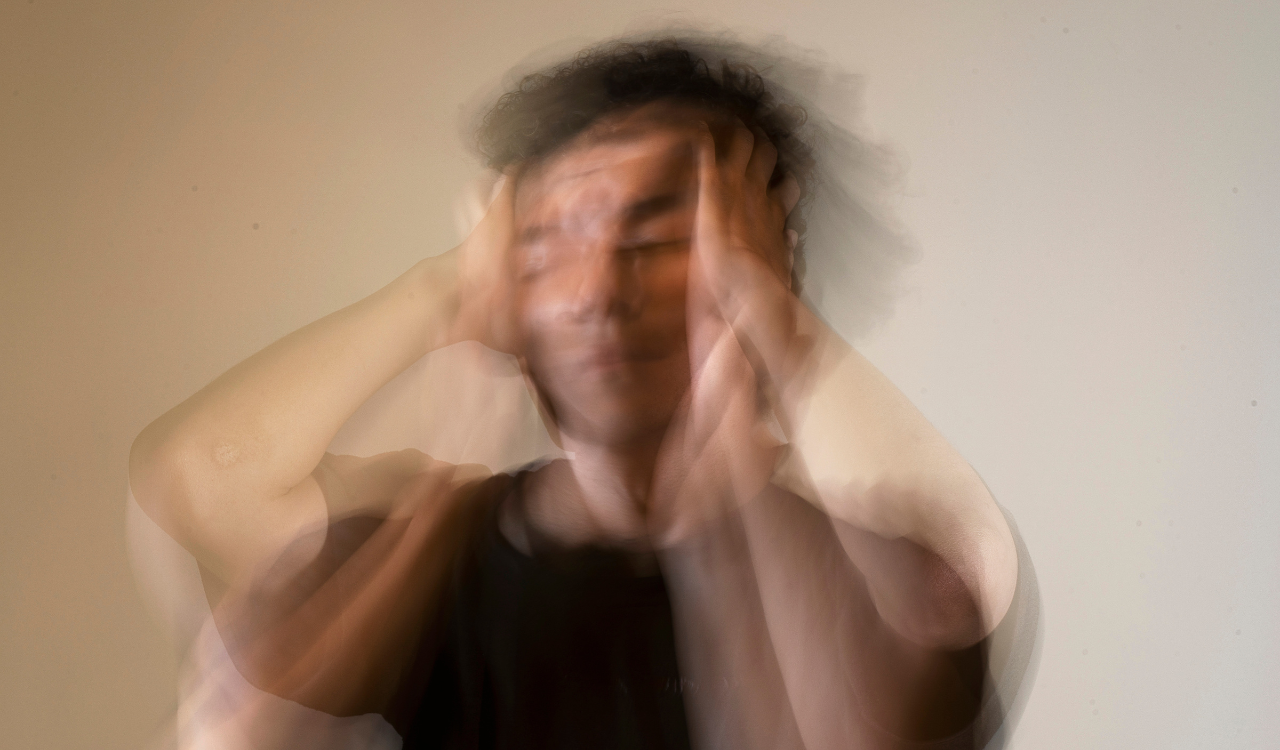

Brands, particularly skincare, should lean harder into results and benefits. Gen Z isn’t afraid of science; they welcome it, in fact. And if you can demonstrate the end result of that science on an actual human being, even better.

Sure, there’s the occasional status purchase here and there, but for the most part, it’s all about an elevated, values-driven take on bang for the buck. These kids are smart, they do their homework, and they’re very rarely influenced by “influencers.” And according to LendingTree, a Gen Zer spends $2,048 annually on beauty. While that’s less than millennials dole out each year ($2,670), it’s still a considerable jump from the national average of $1,754.

By the Numbers

To gain current intel on Gen Z beauty preferences, The Robin Report solicited the help of Reston, Virginia-based The Benchmarking Company. Tapping into its organically grown base of 300k+ vetted beauty and personal care buyers (which it cutely dubs thePinkPanel), it disseminated a comprehensive beauty-preferences survey for all produce categories in June to 453 Gen Z panelists.

Before I topline some of the truly fascinating findings yielded by this survey, let me start with some quick stats about the group of young respondents. Note: As with any survey, some Qs go unanswered. Thus, these stats may not comprise a full 100 percent in every category.

Of course, in terms of annual household income, since Gen Z spans ages 12 to 27, a decent chunk of these respondents are students and/or still living at home. More than a few moms and dads are supporting their kids’ beauty-loving lifestyles.

Where They’re Shopping

You guessed it: Amazon, Amazon and more Amazon. In fact, 74 percent of total respondents shop there. Still, the digital behemoth is hardly their only source for scooping up skincare, hair care, makeup, and fragrance. And superstores, including Target and Walmart, are basically getting the same as Amazon, at 75 percent.

Since 66 percent of this group responded positively to the statement “I shop in a variety of places, depends on what I’m looking for,” they’re literally all over the place, from Ulta (65 percent), Sephora (62 percent) and drugstores (51 percent), to a brand’s own website (42 percent), and grocery stores (19 percent). Clocking in at much lower percentages are luxury department stores (15 percent), legacy department stores (13 percent) and salons and spas (13 percent).

Opinionated Feedback

Here’s what they had to say about a few of these retail outlets:

- “I like shopping at Ulta and Amazon the most, just because they have great variety and so many sales,” says one shopper. “But occasionally I’ll go to department stores or Sephora if I’m looking for something higher-end, or more specific.”

- “I like T.J. Maxx,” says another shopper. “It’s not consistent with what they have, but when they do, it’s always a good price.”

- One respondent got deeply granular about the top five preferences: “My favorite retailers for beauty shopping are 1) Sephora – they have a great selection and you can try on products in-store; 2) Ulta – I love their mix of high-end and drugstore brands; 3) Glossier – their online shopping experience is super smooth and their branding is top notch; 4) Amazon – it’s convenient for quick, reliable deliveries; 5) The Ordinary – their website is great for getting straightforward, affordable skincare.”

Brands They Love (and Why)

As it turns out, Gen Z shops for beauty the same way their older counterparts do, aggregating a high-low mix of its most cherished products. According to the survey, 30 percent opt for a combo pack of mass ($20), masstige ($20-$54) and prestige ($55+) price points. Not surprisingly, only 4 percent claim to purchase exclusively prestige beauty.

Alongside The Ordinary, a Lauder-owned skincare brand that typically lasers in on a specific ingredient such as retinol or peptides and is beloved for its high quality and low prices, other wallet-friendly options like Bath & Body Works fragrances and shampoos and conditioners by Garnier and Shea Moisture top the list. Occasionally, an outlier surfaced in the mix who name-checked the wildly expensive 111Skin “because it’s prestige.”

One respondent described Kérastase, one of the more expensive hair care brands in the L’Oréal portfolio: “Kérastase never disappoints but she’s pricy. The smell and formulas make me feel like I’m getting salon hair every wash.”

In no particular order, other favorite brands cited time and time again by survey-takers: La Roche-Posay, Neutrogena, Olaplex, Sol de Janeiro, CeraVe, Cetaphil and Aussie. The through-line? With the exception of La Roche-Posay and Olaplex, which tilt in a slightly pricier direction, all of these brands are ultra-affordable.

The Biggest Purchase-Drivers

In general, Gen Zers are not “discovery” or “thrill of the hunt” shoppers. A whopping 95 percent of respondents seek out reviews before purchasing a new product. And as a beauty reporter myself, I was heartened to learn that 59 percent actually take the time to read the product info pages on brand websites. Other sources of intel include asking friends and family (49 percent), scrolling TikTok and Instagram (46 percent), and reading beauty publications (28 percent). As for the impact of influencers, only 12 percent of respondents deem it “very important” and 25 percent say it’s “somewhat important.”

A few paths to purchase surprised me, I have to say. A hefty 48 percent said they look at “before and after” photos, and 35 percent rely on consumer claims along the lines of “96 percent of women agree wrinkles appear diminished in seven days.”

How Core Values Fit into the Equation

This is where it all gets a little tricky – and slightly depressing, if I’m being completely honest. Kicking off this piece, I stated that the top three attributes Gen Z is looking for in beauty products are efficacy, affordability and rock-solid brand values.

It’s just that the values piece of the puzzle is a very, very distant third. While 83 percent demand efficacy and 72 percent are driven by price, only 17 percent care about natural ingredients and 15 percent are fixated on cruelty-free. Sustainable packaging clocks in even lower, with just 4 percent.

These survey-takers are still young, right? There’s plenty of time for all the hard work beauty brands are doing to be better stewards of the planet to sink in with Gen Z. In the meantime, while they wait for younger buyers to appreciate their efforts, these same brands can still keep making incredibly effective products at really great prices.

Retail + Brand Response

In one of its recent “Mind the Gap” reports, which zeroes in on Gen Z, McKinsey & Company said it fully expects this cohort to continue helping the beauty industry to continue its growth trajectory of six percent a year, reaching roughly $580B by 2027.

So what can brands and retailers do to ensure that Gen Z keeps opening its wallets?

Here are a few ideas.

- On the retail side, tread very, very carefully with tiny independent brands with no track record; they appear to have next-to-no traction with Gen Z.

- If there are ways to monitor TikTok and react quickly to viral hits – and this would be easier for, say, a CosBar than a Neiman Marcus – go for it.

- If not, just take a wait-and-see approach to the staggering amount of new beauty brands that pop up every year.

- On the brand side, particularly with skincare, lean harder into results and benefits. Gen Z isn’t afraid of science; they welcome it, in fact. And if you can demonstrate the end result of that science on an actual human being, even better.