The Timberland 50th anniversary campaign celebrating its iconic “Original Yellow Boot” features a celebrity lineup to appeal across generations and cultures. Supermodel Naomi Campbell, born in 1970, three years before the first yellow boot was introduced, takes center stage wearing nothing but her pair of boots.

VF will get a cash infusion after the EssilorLuxottica deal closes at the end of the year, so the immediate financial pressure is off. But Timberland may be the next brand to get a sendoff, especially if this year’s revival efforts don’t move the needle.

Timberland’s New Edge

R&B singer-songwriter Teddy Swims, British-Nigerian artist Slawn (Olaolu Slawn) and model, performance artist and Transactivist Kai-Isaiah Jamal are also featured in the Timberland 50th anniversary campaign, shot by famed British fashion photographer Jamie Morgan, who goes back to 1984 with Naomi Campbell in her first professional engagement.

“We’ve seen such incredible energy behind the brand since our anniversary, with several luxury fashion collaborations this year alone,” explained Timberland CMO Maisie Willoughby in a statement, citing collaborations with Louis Vuitton, Wales Bonner and White Mountaineering this year.

“The ICONIC campaign is an extension of that energy, signifying a fresh direction for the brand and fueling our status as the arbiter of boot culture. This campaign is incredibly bold and authentic, and Timberland has always been about embracing originality; and what is more iconic than the Original Yellow Boot?” she continued.

Perception vs Reality

As iconic as the Timberland Original Yellow Boot may be, regrettably its brand ROI is sorely lacking as measured by its recent performance under VF Corp’s management. The new “ICONIC” campaign has the feel of staging the brand to prepare for a sale, like when staging a house for sale.

I may be wrong, but in the recent first-quarter 2025 earnings call, VF CEO Bracken Darrell hinted as much: “Timberland is a work in process. I’m excited about Timberland, but we’re not focused on it for now,” he said, as bigger headaches in the company’s larger Vans brand commands most of the attention.

For context, VF Corp. ended the quarter down nine percent, dropping to $1.9 billion from $2.1 billion last year and Vans was off 21 percent, from $738 million to $582 million. Timberland was less than half that, $229 million, but its revenues dropped 10 percent.

Bumpy Road

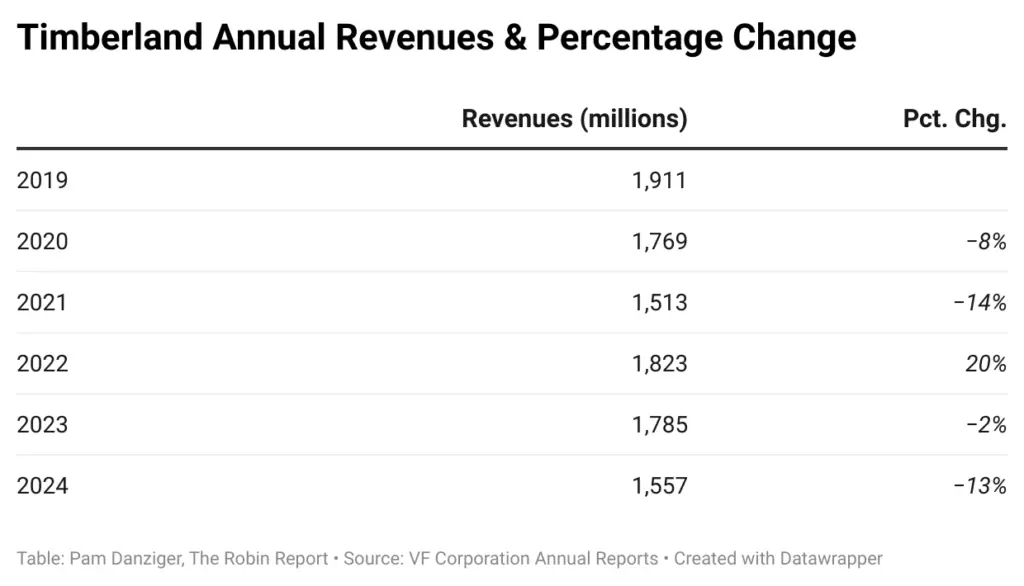

In 2011, VF acquired Timberland, along with Smartwool brand, in a deal valued at $2.3 billion. At the time, Timberland was said to have generated $1.4 billion in 2010. After the acquisition, Timberland’s results were combined with other brands under VF’s Outdoor reporting segment and didn’t come out of hiding until 2020, when revenues were reported at $1.8 billion. Prior to that, VF revealed only the brand’s percentage change, and from 2019 to 2020, global revenues declined eight percent.

Here’s a look at the past six year’s performance and it’s not a pretty sight, down nearly 20 percent from 2019’s high:

If the first three months of this fiscal year are any indication, Timberland could be headed toward another double-digit or high-single digit decline. The latest reporting had one ray of light: a two percent uptick in Timberland sales in the Americas, but the rest of the world was way off, EMEA down 16 percent, APAC off 25 percent and elsewhere 10 percent.

On a brand level, the company doesn’t report geographic breakdowns, but corporately, the Americas account for just over half of total revenues. And Darrell mentioned in the latest earnings call that Timberland’s results vary widely in different parts of the world, saying that “is one of the challenges to Timberland.”

Changing of the Guard

CEO Darrell joined VF in July 2023 with a mission to turn the company around. According to his CV, he hasn’t had any experience in fashion retail, but he grew the Logitech company to nearly $5 billion and before that, he turned around the Old Spice brand while at Procter & Gamble. Now he’s responsible for a dozen or so brands and a company about double the size of Logitech.

As VF’s fixer, Darrell went right to work cutting costs and bringing down debt. But clearly, brand growth has eluded him. “The beating heart of the corporation are its brands,” observed Robin Lewis. “And with all due respect, while Old Spice and Logitech are two brands that Darrell successfully turned around, what he’s facing now is a portfolio of distinct autonomous apparel lifestyle brands, all of which are in trouble.

“Darrell had better remember that in this over-stored, over-websited industry, when a consumer leaves a brand, for whatever reason, they have any number of new brands to choose from, right across the street or a key-tap away. And that is a brand problem, not just a product or marketing fix,” Lewis continued.

Darrell has also focused on getting the right people on his team, including a new Vans president, CFO and chief strategy and transformation officer. Timberland got a new president too. Nina Flood, a 20-year VF veteran, was promoted from vice president/general manager for Timberland EMEA to global brand president in December 2023. Before joining VF in 2003, she worked in marketing roles at Guess.

Flood replaced previous brand president Susie Mulder, who joined VF in April 2021 and left last November to join the athletic sportswear brand NoBull. Prior to Timberland, she served for nine years as CEO of the women’s casual classics fashion brand Nic+Zoe. Before that, she’d put in 15 years as a McKinsey & Company partner and holds an MBA from Harvard.

Who knows if Mulder’s quick departure after Darrell came on board was a result of a personality clash or they didn’t see eye-to-eye how to fix Timberland. But on paper, she looked to have the right stuff to manage a brand of Timberland’s size and scale.

Strategic Review

Back in February, Darrell introduced the company’s Reinvent transformation program “to enhance focus on brand-building and to improve operating performance.” He explained initial priorities were to turn around Vans, improve its overall North America performance, reduce costs and strengthen the balance sheet.

In addition, he announced a Strategic Portfolio Review. “Consistent with the goals of Reinvent, VF has initiated an in-depth strategic review of the brand assets within the portfolio, in alignment with the Board of Directors, to ensure the company owns the brands that it believes create the greatest long-term value.”

The initial result of that strategic review was to divest the Supreme streetwear brand. VF acquired Supreme for $2.1 billion in 2020 after it rose to prominence through a Louis Vuitton x Supreme collaboration in 2017. However, Supreme never fit comfortably under VF’s business model and was sold off to EssilorLuxotttica of eyewear fame for $1.5 billion in July.

What Goes Around, Comes Around at VF

There is a curious connection with VF and LVMH in each other’s orbit. The new Louis Vuitton x Timberland collaboration is still in early days, but it’s going to be hard to top the Louis Vuitton x Supreme collaboration. Somehow LV’s magic touch didn’t survive VF’s acquisition of Supreme. The jury is out on the current collab and its star-studded Timberland 50th anniversary campaign to see if Timberland can rise to the same buzz level.

Writing earlier this year, Robin Lewis thought Timberland was a good candidate for a sale and that sentiment was shared by Williams Trading analyst Sam Poser. “Timberland has been a disappointment for VFC since it was acquired in 2011. We believe that VFC should sell Timberland.”

VF will get a cash infusion after the EssilorLuxottica deal closes at the end of the year, so the immediate financial pressure is off. But Timberland may be the next brand to get a sendoff, especially if this year’s revival efforts don’t move the needle.