After months of pandemic-induced retail shutdowns, it comes as no shock that consumers turned online to do their shopping. Non-store retail sales grew 22 percent to end the year just under $1 trillion ($968 billion). In a nearly $4 trillion retail market, excluding autos, gasoline and food service, that means roughly one-out-of-four retail dollars happened outside brick-and-mortar stores’ four walls, including $883 billion conducted through electronic shopping and direct mail.

The Digital Retail Highway

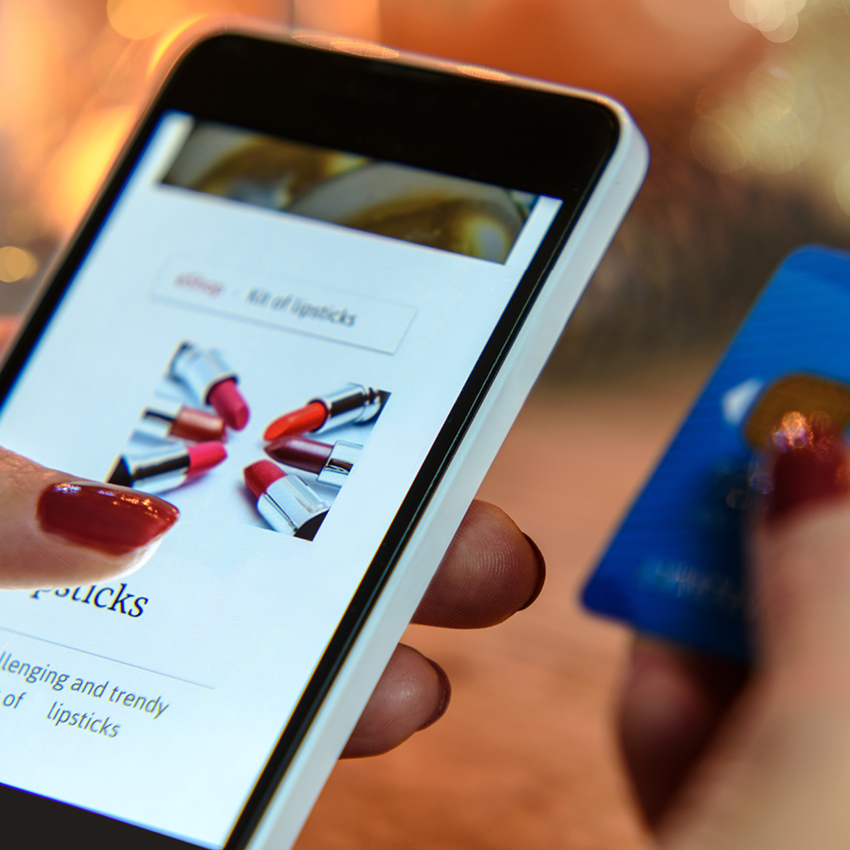

What may have gone unnoticed is how rapidly shoppers chose their mobile devices as the on-ramp to the digital retail highway. Business Insider Intelligence estimates mobile commerce captured 45 percent of ecommerce in 2020, or nearly $400 billion at year’s end.

[callout]Shopping – both virtually and in-store – offers other rewards besides filling physical needs; retail therapy is supported by science that proves its benefits.[/callout]

“Consumers are reliant on digital devices now more than ever, and Insider Intelligence predicts that mobile will inch closer to becoming consumers’ preferred channel for online shopping within the next five years,” it reports. “Mcommerce has the potential to become a major channel for shopping and to change consumer shopping habits.”

With shoppers’ eyes peeled to their mobile devices, they are challenged with successful interactions with retail mobile websites. Forrester reports that half of consumers find it easier to make a purchase on a computer than on their mobile phones, discouraged by the small screens and feeling unsafe transacting with mobile payment services. They also are turned off by not having the same full functionality available on standard websites and say the transaction process is not optimized for mobile phones.

If retailers want to succeed with mobile ecommerce, they need to overcome these limitations. A recent Bazaarvoice survey of over 9,000 consumers worldwide found that more than half (54 percent) of shoppers enjoy virtual window shopping online more than in-store browsing.

Retail Therapy

We all know people shop to buy things they need, but shopping – both virtually and in-store – offers other rewards besides filling physical needs. Retail therapy is supported by science that proves its benefits.

A study led by University of Michigan’s Scott Rick, PhD. in the Journal of Consumer Psychology found retail therapy not only gives people an immediate mood boost, but it can also lift lingering feelings of sadness and depression. The reason is because sadness and depression often result when people feel life is out of control – a feeling all too common after living through the pandemic. By exercising choices when shopping, people can restore a sense of control and autonomy.

Shopping also encourages people to dream and imagine a better life, creating “sensory stimulation that gets us to visualize positive outcomes,” according to clinical psychologist Scott Bea, Psy.D. It’s something that athletes do regularly to create “positive anticipation and reduce anxiety.”

The mood-enhancing value of window shopping, browsing and scrolling through product choices works by releasing dopamine into our bodies. And that feel-good neurotransmitter is released not just when a purchase is made, but during the entire process. “It’s all about the whole journey,” Bea remarks. This partially explains why online shopping carts get abandoned. The joy comes from the anticipation built up throughout the online shopping journey, not just from when the final click is made.

And for online shoppers, there is another dopamine burst when people wait for their packages to arrive. This is a side benefit for subscription services feeding into the unpredictability of what you might receive and the anticipation before you receive it causes growing excitement.

“Whether you’re adding items to your shopping cart online or visiting your favorite boutique for a few hours, you do get a psychological and emotional boost,” Bea explains. “Even window shopping or online browsing can bring brain-fueled happiness.”

Mobile for Moods

Traditional brick-and-mortar retail therapy was curtailed during the lockdowns and people still feel stress and anxiety returning to the store, so they have turned online, and more specifically to their mobile devices to lift their moods. Already destination-central for communications and socializing to overcome loneliness, consumers’ relationships with their mobile devices changed over the course of the pandemic.

With work-from-home the new normal, people’s computers became their virtual workplace and not just a place to retreat for relaxation and fun. They stepped up their use mobile devices for personal time, using them more for entertainment, exercise and retail therapy. A survey by Emarsys, an SAP Company, found nearly 70 percent of consumers spent more time last year on their mobile devices as a mood lifter, stress reliever and a cure for loneliness.

Mobile shopping also got a lift, as mobile’s relaxation effect carried over to shopping. About one-third of consumers said using their mobile devices to shop makes for a more relaxed shopping experience and the same percentage said they make better shopping decisions when relaxed.

As a result, mobile shopping is win/win for consumers who find it a more relaxed way to shop, if those retailers and brands can keep those mobile shoppers happily engaged rather than frustrated by the factors called out by Forrester. Brands and retailers are finding customized apps to be the best way to provide an enhanced mobile shopping experience.

Mobile Breakdowns on the Digital Highway

But not all retail mobile apps are created equal. For every one of the best, like Amazon, Home Depot, H&M, Target, Lululemon and Nike, there are thousands that fail the shopper’s test. The proof? About 70 percent of people who download an app abandon it after only one use, according to the Emarsys survey. With between 2,000 to 2,500 mobile apps downloaded each day, some 90 percent of users don’t stay with the app for more than seven days. Getting consumers to download an app is less of a challenge than getting them to stick around and use it regularly and often.

“The challenge for brands is to retain these new [mobile] customers once we begin to emerge from the pandemic. The key to doing that is to remain relevant to those customers, which means personalization, personalization, personalization,” shares Chris Godderidge, Emarsys’ vice president mobile, who recently published an e-book that provides a roadmap to building and retaining engaged mobile customers.

Too many brands are throwing good money after bad when it comes to their mobile engagement. Emarketer predicts mobile ad spending will reach $174 billion by 2024 and will account for some three-fourths of all digital advertising. However, most of that mobile money is invested in customer acquisition rather than customer engagement.

Godderidge stresses the ongoing need for retailers to continue to promote their app to new customers. The opportunity is great since last year only about 13 percent of smartphone users downloaded a non-grocery shopping or retail app, according to eMarketer.

The bigger hurdle is to get customers to come back and use them again and again. That translates into brand loyalty. Many brands design their mobile apps around loyalty programs, like Starbucks, however they don’t necessarily design them to create greater brand loyalty.

Retail mobile apps designed to drive brand loyalty create engaging, fun and actionable shopping experiences – dopamine-inducing retail therapy. “Offering a personalized shopping experience on mobile was challenging, but now technology exists that can help brands offer a one-to-one tailored experience for each and every customer based on their exact preferences and needs,” Godderich concludes. Speed is of the essence; master your mobile strategy now!