“Who’s the fairest of us all” was made famous by the evil queen in Snow White and the Seven Dwarfs, as she stood in front of her magic mirror. I certainly don’t view Lululemon as the evil queen. Quite the opposite. However, it gives me the provocative metaphor for emphasizing my belief that Lululemon is, and has been, the poster child brand in building a completely holistic retail ecosystem. It is so powerful and engaging with its range of customer experiences that no other retailer in its space even comes close. And now with its acquisition of Mirror (last year) and its patented at-home fitness technology, Lululemon is actually bringing their active and wellness experience into its community of consumers’ homes.

Customers + Lululemon: Co-Created Experiences

I’m not going to meander through Lululemon’s history, which most of you well know. I’d rather emphasize the strategic brilliance of how they have grown their brand into a near cult phenomenon, which very few other retailers and brands have been able to do.

A Luluhead fitness addict can look forward to getting their “fix” in any way they wish. And for Lululemon, its ability to powerfully connect with its devoted aspirational consumers elevates its positioning beyond products and stores to a technologically driven lifestyle business that stands for health and wellness.

Yes, check off perfect merchandising, styling, product (with a couple hiccups), presentation, and on and on. Oh yes, it starts with product. if you don’t have the right product today, you are kaput. Product is table stakes.

Now front and center beyond product, the imperative strategy for success is the big “E” that Lululemon has mastered over and over. Experience. Experience is the most overused word in retailing and the least understood. To put it into perspective, many of us were talking the talk about experiences trumping stuff 30 years ago. Today, we use a megaphone because so many still are not walking the experience walk. Plus, many who have created experiences often miss the mark of strongly aligning their brand with what customers actually want.

In my co-authored book, The New Rules of Retail, we identified and described the most powerful type of experience as one which is co-created by brands, retailers and their consumers. We observed at the time that while Lululemon created a yoga experience commensurate with their image as a lifestyle wellness brand, each consumer attending the yoga class was proactively co-creating a personal, meaningful experience with Lululemon. So, even if a group of consumers are sharing the same yoga event, each one’s personal experience is different than the others. And this personal connection plays a powerful role in making the brand relevant every time they re-visit the class.

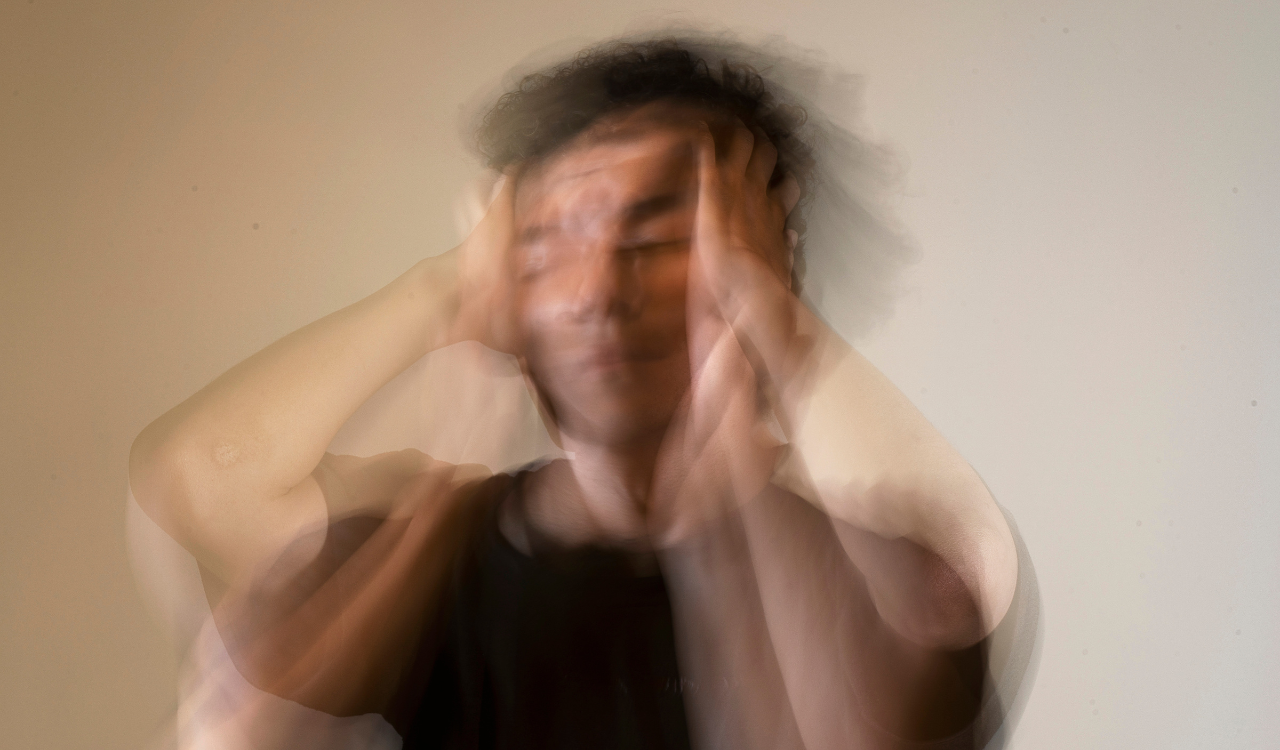

I’m not going to go all psychological on you, but the power of this phenomenon is that consumers get neurologically addicted to these co-created experiences. Or put another way, these elevated experiences release the chemical dopamine in the brain which triggers feelings of euphoria, self-satisfaction, wellbeing — and can lead to addiction. Need I remind you about addicts? They can’t get back fast enough to get their next “fix.” And while enjoying the euphoria of the experience, they buy tons of stuff, and happily pay full price, thus, increasing the value of the store and everything in it.

Creating a New Market

I use the yoga class example because it was one of the earliest co-created experiences following Lululemon’s launch in 1998 in Vancouver as a retailer of yoga pants and other yoga wear. Today, yoga may be the main “fix,” but Lulu has expanded the experience to replicate a similar community vibe for active enthusiasts across its roughly 490 stores worldwide. Beyond yoga wear, Lululemon sells a range of performance-wear including shorts, pants, tops, sweaters, jackets and undergarments, as well as yoga mats, bags, hair accessories and water bottles, (of course).

Founder, Chip Wilson’s first and most important strategic move was to create the brand positioning that would differentiate it from the giant players like Nike Adidas and Under Armour, so as not to compete with them head on. So, he created an apparel niche that combined the functionality of workout wear with a style twist that it could be worn as streetwear, post yoga class. In fact, some observers believe he actually coined the term athleisure fashion.

Talk about building lifestyle experiences beyond yoga classes, each store shapes its events to align with the local community or the neighborhood it resides in, such as “Run, Yoga, Breathe, Laugh” (RYBL). And they partner with local fitness and yoga coaches they call Lululemon ambassadors to run these events. So, these communities of health and wellbeing addicts who call themselves “Luluheads” can’t get enough of the social, community experience and workout events, like “Sweat with Us” classes, free yoga classes and weekly run clubs. All of this is topped off with Lulu’s annual (pre-pandemic) “Sweat Life Festival,” which draws roughly 6000 attendees for a weekend of — you got it—learning, sweating and inspiring.

The Next Wave

Following Wilson’s two successors and some speed bumps, enter new CEO Calvin McDonald in 2018. It’s clear that he understands the power and unique positioning of Lululemon. I would define his role as an accelerator. Upon taking the helm, McDonald spearheaded the brand’s five-year strategic plan with three pillars: product innovation, omni guest experiences and market expansion. It also included a membership program (providing free shipping, free yoga classes and other perks). And you can check the boxes on all three over the past three years.

Furthermore, for a glimpse into Lulu’s future, a 20,000 square-foot megastore opened in Chicago in 2019, (average store size across the fleet is 3000 square-feet). It features Lulu’s traditional fitness focus with exercise rooms and a meditation space. Following one of the 10 different fitness classes), customers can head into Fuel, a restaurant where they can order all things mostly healthy, such as smoothies, beer and salads. And let’s not forget that even though this mega-experience is the “fix” that Luluhead addicts keep returning for, there is that apparel that they purchase off the rack, happily paying full price.

The brand expects to expand the mega-concept to about 10 percent of its stores by 2023. The larger space greatly expands the experience, choice of fitness programs, socializing in the restaurant, as well as providing more space to roll out new product categories. They have already launched into the personal care category, and they see major growth in menswear.

“Mirrorheads”

Sticking with my fairytale metaphor, Lulu’s acquisition of Mirror in 2019 means that consumers don’t always have to go to the store for their “fix.” Lulu will bring it right into their homes for a $1495 purchase price with reasonable financing and unlimited access for family members included in the monthly membership fee. The wall-mounted mirror with its patented at-home fitness technology is timely because at-home workouts, accelerated by the pandemic lockdowns, have become a rapidly growing trend. Just look at the breakout brand, Peloton, with its launch of a wildly popular fitness community. The Mirror is a de facto nearly invisible home gym, requiring only a few feet of exercise space. It offers live classes and a library of thousands of on-demand classes, across 50 different programs, for expert and beginner levels. It also provides real-time performance feedback as well as the ability to connect with other Mirror users. The virtual Lulu workout community is activated!

Think about it. A Luluhead fitness addict can look forward to getting their “fix” in any way they wish. And for Lululemon, its ability to powerfully connect with its devoted aspirational consumers elevates its positioning beyond products and stores to a technologically driven lifestyle business that stands for health and wellness.

CEO McDonald describes the overlap between new and existing Luluheads, “That’s where we get excited as we as we build out the synergies of having a Lululemon guest buy into a Mirror and have the Mirror guest buy into Lululemon as their sweat solutions.”

Mirror is expected to drive between $250 and $275 million in revenues this year. And they estimate that there will be 200 Mirror shop-in-shops by the 2021 holiday season.

By The Numbers

Finally, to prove real-time evidence that Lululemon has no competitive match because it has truly created a new and unique market, the financials don’t lie.

- 2020 sales for Lululemon were up 11 percent compared to 2019 and the direct-to-consumer ecommerce sales grew to 52 percent of total revenues compared to 29 percent in 2019 (DTC Ecom was up 101 percent).

- The company has grown to $4.4 billion and was one of the companies that delivered stellar performance during a pandemic year where sales in apparel were down 27 percent for the year.

- Gross margins for Lululemon also improved in 2020 to 56 percent as compared to 55.9 percent in 2019.

- The company ended the year with $1.2 billion in cash and no debt.

- Entering 2021, the brand continues to show strong growth and performance. For the first quarter of 2021, compared to the first quarter of 2020, net revenue increased 88 percent to $1.2 billion.

- Company-operated stores net revenue increased 106 percent to $536.6 million.

- Direct to consumer net revenue increased 55 percent to $545.1 million.

- Direct to consumer net revenue represented 44.4 percent of total net revenue compared to 54.0 percent for the first quarter of 2020.

- Gross margin was 57.1 percent compared to 51.3 percent in Q1 last year.

- According to CoStar, Lululemon ranks number-one in productivity among apparel retailers, with $1560 sales per square-foot, vs. the average for most retailers of about $325. Apple ($5546) and Tiffany ($2951), score higher in the general retail category.

Accountability

Lululemon has a strong community ethics focus and has been working to improve both people and planet initiatives with disciplined goals for sustainable materials, renewable electricity, and an intense reduction in carbon emissions.

The company rolled out IDEA – Inclusion, Diversity, Equity and Action — focused on the systemic changes and actions that need to make the company more diverse and inclusive reflecting the communities which it serves. In 2020, the employee engagement score was in the top 10 percent of all retailers.

Former CEO Christine Day said it all, “While others may try to mimic parts of our business, it is impossible to copy a personality.”