News recently broke that the Nordstrom brothers, CEO Erik and President Pete, have agreed to take the company private through a merger with Mexican retailer El Puerto de Liverpool in a deal valued at $3.8 billion.

While Richard Baker claims to be no retail merchant but a real-estate guy, he describes HBC as primarily a “real-estate company” and he is likely to do with Neiman Marcus and Saks what he typically does – squeeze the most value out of his investments. The Nordstrom brothers, on the other hand, are retail merchant princes who can bring Nordstrom back as the exemplary luxury retailer it once was and can be again.

While the family believes this “bird in the hand is worth two in the bush,” their deal has a feeling of desperation about it when you look at who Nordstrom is merging with. This merger is slightly counterintuitive if you consider Nordstrom’s heritage. El Puerto de Liverpool operates some 300 stores – 124 Liverpool and 186 Suburbia stores plus 28 Galerias shopping centers in Mexico. It generated nearly $10 billion (MXN $ 195,991 million) in 2023, about 90 percent in retail, the rest from credit and real estate, both of which grew over 20 percent year-over-year with retail advancing 10 percent.

Fiddling While Rome Burns

Nordstrom seems to be caught in the undertow of the major legacy department store sector’s death spiral. Aside from Macy’s, Nordstrom is the only other one standing. Nationally, department store revenues dropped over 50 percent from 2010 to 2023, while the rest of retail basically doubled in the 13-year period. That drop made department stores the biggest losers in all of retail, with the exception of bookstores and office supply/stationery stores which came close. Nearly every other sector in retail grew double digits from 2010 to 2023.

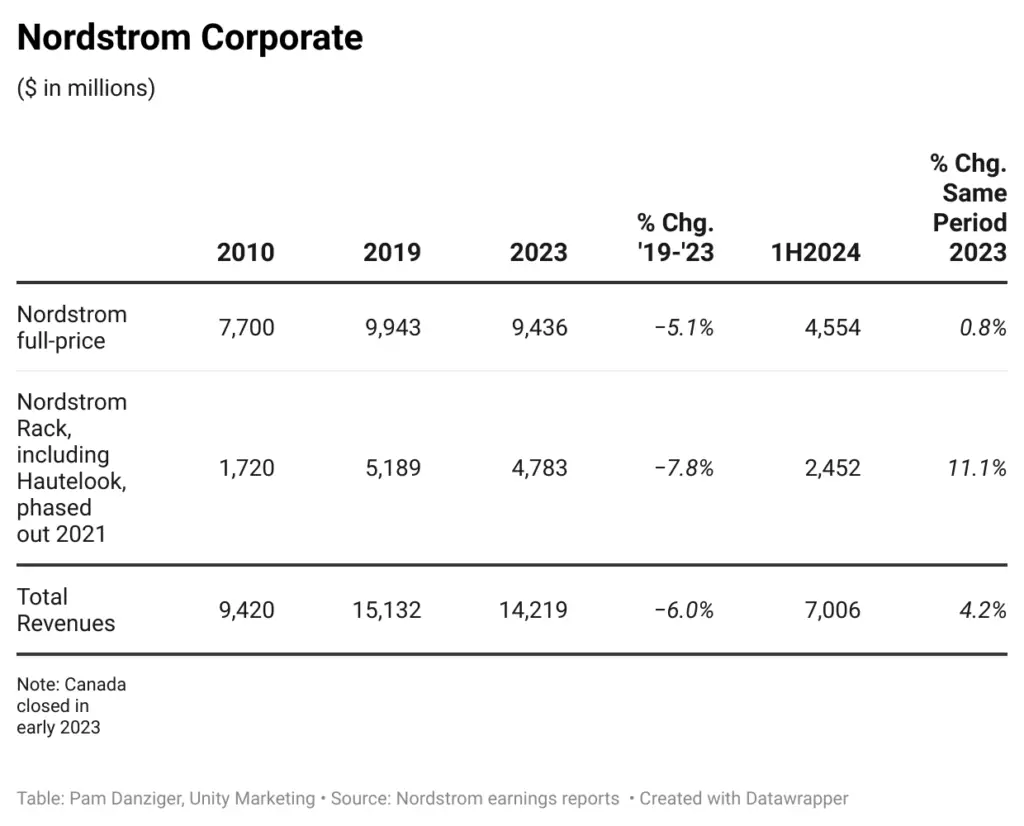

- Fiscal year 2023, Nordstrom reported a six percent cut in revenues after shutting down its Canadian operations, but the move may have been more a symptom than a cure for the troubles that beset the company.

- While it just reported second-quarter 2024 earnings, which squeaked ahead four percent in the first six months, almost all that growth is attributed to its off-price Nordstrom Rack spinoff while flagship Nordstrom remained level.

- Going back further, full-price Nordstrom dropped nine percent from $10.3 billion in the fiscal year ended February 2019 to $9.4 billion in 2023. Since then, Nordstrom went from 115 U.S. locations to 93 and Nordstrom Rack from 238 to 258 stores. This year it announced that another 23 Nordstrom Racks are slated to join the party, more than opened in the last four years.

All of which is to say that Nordstrom, a preeminent luxury retailer with a stellar reputation founded in 1901, is banking on its discount offshoot to keep the company afloat. And that, my friends, is the wrong way around. Has Nordstrom management been fiddling while its Rome burns?

Rack Feeder

Originally, Nordstrom Rack was intended as a way for younger, less affluent consumers to enter the Nordstrom ecosystem and eventually graduate to Nordstrom’s full-priced stores. Obviously, only the company knows whether that strategy has been successful, but my guess is Nordstrom Rack customers are intrinsically different from flagship Nordstrom customers, with little crossover between the two.

Since the pandemic, retailers and the consumers on whom they depend have been hit with all kinds of economic challenges, including rapidly rising inflation that sent even some well-heeled customers to discounters to save a few dollars. So, Nordstrom Rack still looks like a good bet for the value shopper, upscale and everyone else.

That said, overall results at Rack have been basically flat from 2019 through 2023 and a large part of Nordstrom Rack’s 11 percent gains in the first half of 2024 were from new store openings. As it is, second quarter Rack growth of nearly nine percent dropped from the first quarter’s 14 percent uptick.

Strange Bedfellows

Back in the day (in 2010) and up to 2019, Nordstrom operated 115 full-line stores that generated $7.7 billion or just over 80 percent of its total revenues. By 2023 the full-line share dropped to 66 percent and the number of full-line stores went to 93 locations, while Nordstrom Rack nearly tripled the number of stores to 258.

The Pareto Principle – 80 percent of outcomes result from 20 percent of causes – might suggest that in 2010 Nordstrom Rack was a good investment for the future, generating 20 percent of total company sales.

But in making the calculated business decision to bank on Rack, Nordstrom’s leadership was violating its core principle of putting the customer first. The 20 percent of causes that made Nordstrom so great over its nearly 125 years in business was catering to upper-echelon customers who wanted the best of the best, not cheap knockoffs or second-class shopping experiences.

For the 20 percent of affluent customers who generate 80 percent of Nordstrom’s legacy business, Nordstrom Rack is a non-entity. Further, it could be a potentially fatal distraction for leadership by putting profits over people – its prized luxury customers – who count the most for the enterprise’s well-being.

Bloom Off the Rose

As mentioned, through the first six months of 2024, ending August 3, Nordstrom grew four percent, from $6.7 billion to $7 billion, but virtually all that growth was attributed to Nordstrom Rack. The Nordstrom flagship advanced less than one percent, largely credited to its second-quarter Anniversary Sale and the strength of its expanded private brand selections. But both are value-based customer savings opportunities that hide weakness in its core full-priced business.

Its New York City flagship store opened in late 2018 for men and expanded to women and children in 2019. It was called out as the company’s top revenue producer and generated the fastest-growing sales across its fleet. The Robin Report’s Deborah Patton is duly impressed with the 57th Street store but says Nordstrom has yet to extend the magic to the rest of its stores or online. “The 57th Street store is dazzling, ultra-upscale, creative and showcases cool emerging brands. But I keep wondering about the disconnect between that store versus their other stores, which are so depressingly dull and their website, which is totally pedestrian and middle-of-the-road. Sometimes I feel Nordstrom is bipolar.”

While Nordstrom Rack is the company’s greatest strength in management’s and Wall Street’s eyes, its apparent success is obfuscating the weakness in its flagship full-priced brand. I recently paid a visit to my local Nordstrom Rack store and couldn’t see what the excitement was all about.

There were no window displays to entice me in, rather the store looked closed because a nearly opaque sunscreen blocked sightlines into the store. Displays of fashion accessories and beauty that greeted me on the right side of the door were attractive, but that was maybe ten percent of the store. The rest of the sections were nondescript and besides two indifferent clerks manning the cash registers, there was nothing in the way of customer service, reinforcing the bipolar nature of the company. Frankly, I’d rather shop at Kohl’s.

Financial Machinations

By any measure, the Nordstrom business is fragile. The company is currently guiding on overall revenues to range down one percent to one percent growth in fiscal 2024. Maybe as a Hail Mary, fourth-generation Nordstrom brothers Erik and Pete have accepted the offer by Mexican retail company El Puerto de Liverpool to take the company private.

All outstanding shares in the company will be acquired, except those held by members of the Nordstrom family and Liverpool at $23 per share. The deal will be financed by a combination of “rollover equity and cash commitments by the Nordstrom family and Liverpool, plus $250 million in new bank financing.” AP reports Liverpool already owns about ten percent of company stock.

The family owns roughly 30 percent of Nordstrom stock. Before the merger news, shares were trading in the $20 range, down from just under $50 at the start of 2019. And that was the price offered per share in the 2017 failed private bid.

However, a special committee of “independent and disinterested directors” is reviewing the proposal to determine if it is in the best interests of Nordstrom and all shareholders. In a statement, the company stated, “There can be no assurance that the Company will pursue this transaction or other strategic outcome, or that a proposed transaction will be approved or consummated.” We’ll see.

Unpromising Partner

As exceptional a retailer as El Puerto de Liverpool is – the Intercontinental Group of Department Stores awarded it second place in 2023 – it looks to know little about the U.S. retail market and even less about the luxury business.

It might make a good partner for Nordstrom Rack off-price business, but its luxury flagship? I think not. Here’s a novel idea: why don’t they sell off Rack and keep the Nordstrom flagship, which made the company great once and can do so again?

Spinning off Nordstrom Rack might be the smart thing to do now; but then what is Nordstrom Rack without Nordstrom? A partnership with El Puerto de Liverpool’s business is a good fit. What is Nordstrom without Rack? It could be everything it once was. Freed from the demands of Rack, management’s attention would be re-concentrated where it ought to be – on the flagship, which has thrived for more than a century although now struggling.

Here’s the headline: Nordstrom could be a beacon of hope for luxury shoppers after Neiman Marcus gets gobbled up by Saks Fifth Avenue under HBC’s Richard Baker ownership. “Richard Baker has an absolutely terrible record when it comes to making acquisitions work,” observed The Robin Report’s Warren Shoulberg, citing the failure of the Lord & Taylor and Gilt Groupe Fortunoff acquisitions.

And while Baker claims to be no retail merchant but rather a real-estate guy (he describes HBC as primarily a “real-estate company”), he is likely to do with Neiman Marcus and Saks what he typically does – squeeze the most value out of his investments. The Nordstrom brothers, on the other hand, are retail merchant princes who can bring Nordstrom back as the exemplary luxury retailer it once was and can be again.

Flagging Flagship

Full disclosure: I have nothing but respect and admiration for Erik and Pete Nordstrom and I absolutely love shopping at Nordstrom. Obviously, I’m looking from the outside in, not privy to the company’s inner workings or the corporate data they have at hand.

However, my analysis suggests that Nordstrom Rack has been a distraction that may be keeping the brothers and their leadership team from focusing on the company’s most important asset and their most important customers who hold the greatest promise for long-term sustainable success.

I could be wrong, but Nordstrom Rack is not the retail franchise I’d hitch my wagon to. Luxury and discount retailing don’t play well together. Better to throw off the one where the competition is greatest and lean into the other where, despite intense competition, there is sure to be greater opportunity as HBC’s Richard Baker starts to unravel Neiman Marcus and Saks Fifth Avenue’s businesses.