Department stores in the United States seem to be slipping into obsolesce, but in Tokyo, they dominate. Isetan is a massive, elegant, nine-story (plus two lower levels and a separate menswear building) retail bastion in the popular Shinjuku district. The lower-level food hall is both a gustatory thrill and a visual spectacle. Hong Kong is now firmly within China’s purview, and government action in Beijing has heavily influenced life there. Tokyo’s current retail dynamics stem from global monetary policies as it finds its post-pandemic footing.

Diminishing HK Luxe

The Queen’s Road and Hong Kong’s Central District were once the beating heart of retail creativity and imagination in Asia. It is still a popular destination for dining, selfies, and drinks, but there is a conspicuous absence of branded shopping bags. While Gucci, Prada, Tod’s, Chanel, BGLVARI, Louis Vuitton, and other global luxury marques still adorn the glittering facades, on closer examination the storefronts are staffed with underutilized associates more adept at garment folding than ringing up sales. Gone is Joyce, the legendary boutique that defined luxury retail in the region for decades, along with its neighbor, Shanghai Tang’s flagship. Both stores can be found elsewhere in Hong Kong tucked into malls (Joyce was acquired by Lane Crawford in 2020). Sadly, Hong Kong’s luxury magic seems to have faded. While shopping bags may be scarce on The Queen’s Road, they have hardly vanished. They have migrated elsewhere. Malls are ascendant. Malls have long been the axis of retail and social activity for Hong Kong locals. Now, after a pandemic dip, they are jammed with local consumers seemingly anxious to spend abundantly on affordable to mid-range brands and accessible luxury.Tourist Vanishing Act

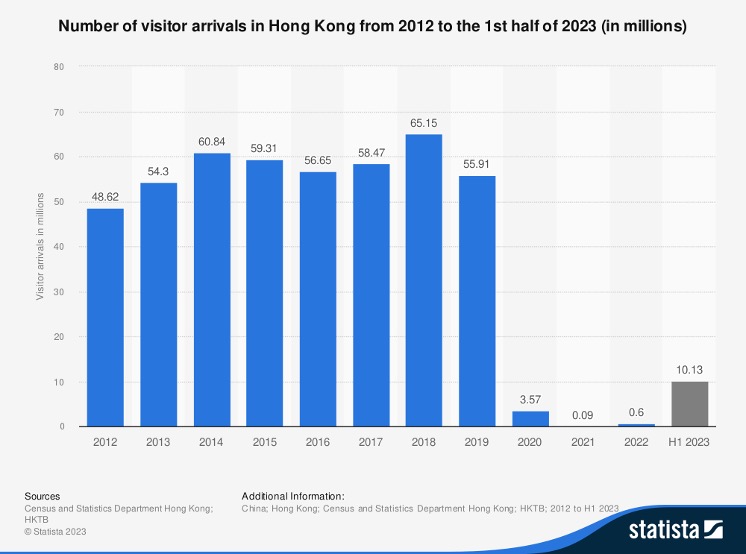

While local wallet power is visible, tourists are not. Hong Kong’s duty-free status once granted the island nation (now a region under China’s control) its position as a luxury leader. This sector suffered a triple whammy beginning with the anti-China protests in 2019, followed by the zero-Covid policy lockdowns in 2021 and early 2022, and finally, China’s establishment of a mainland duty-free zone on the island of Hainan, truncating Hong Kong’s luxury retail tourism from affluent mainlanders. So, fickle world travelers simply moved on. The dearth of British, European, American, and mainland Chinese tourists is evident, with visitor arrivals plummeting from 65.15 million in 2018 to 10.13 million in the first half of 2023 according to the Hong Kong Census and Statistics Bureau.

As tourism numbers collapse, large retailers are scaling back. Harvey Nichols is vacating its five-story flagship store in Central after nearly 20 years. Burberry, Valentino, and LVMH’s Tiffany are all closing stores in Hong Kong despite average retail rents dropping 40 percent since 2019.

New Shoots

Emerging from this disruption, hints of Hong Kong retail innovation are evident in the popular Hollywood Road neighborhood. PMQ (Police Married Quarters) sits in a walled compound that formerly served as worker’s housing for a few decades starting in the 1950s. PMQ now hosts a government-supported incubator filled with studios, shops, and restaurants. The place is the antithesis of a teeming lackluster Hong Kong mall. Here, it feels full of promise — but sadly short of shoppers. Still, we feel some of that Hong Kong retail magic. Glocal MahJong is a joy of a shop that sells kitschy mahjong-themed purses, socks, soaps, a doggie mahjong set, and other merch. There is a boardgame shop devoid of common offerings, along with many local designer and fashion boutiques. If the entrepreneurial energy in these shops intersects with the shopping mania so obvious in the malls, it could be the cornerstone of Hong Kong retail’s next iteration.

Tokyo: The Siren Song

In Hong Kong, the local language is Cantonese while in mainland China it is Mandarin. In Tokyo we are traveling with someone who understands the two languages and to his ear, many of the conversations swirling around us in Tokyo were in both. In contrast to Hong Kong, retail tourism is thriving in Tokyo. A sustained weak Japanese Yen attracts throngs of bargain-hungry tourists, including large numbers from Hong Kong and China, while locals are scarce at the tills.

Department stores in the United States seem to be slipping into obsolesce, but in Tokyo, they dominate. Isetan is a massive, elegant, nine-story (plus two lower levels and a separate menswear building) retail bastion in the popular Shinjuku district. The lower-level food hall is both a gustatory thrill and a visual spectacle. Go to the top floor if you are in the market for traditional Japanese luxury to experience the kimono salon. The interstitial eight floors house some of the best global and local fashion and merchandise. Department store giants Takashimaya, Mitsukoshi, Daimaru, Parco, and others are equally strong retail tourism magnets to those who follow fluctuating Japanese Yen and rush to the stores.

Retail tourism’s dominance is evident in a few offbeat specialty boutiques. After a sustained deflationary period accompanied by a strong Yen, inflation returned to Japan as its currency plunged in response to rising global interest rates. Faline and the TinTin shop, while formerly well-stocked with rarefied local and imported goods, appear short on both merchandise and customers. The smaller shops are in stark contrast to the bursting racks and vibrant activity at the international retail giants Uniqlo, Muji, and Onitsuka’s flagships in the Ginza neighborhood.

Stealth Innovation

That said, more interesting retail experiences are found in quieter neighborhoods where tourists are scarce and things move at a less frenetic pace. The much-hyped, Boston-based athletic/streetwear brand New Balance has long been popular in Japan. It opened the New Balance T-House in 2020. The shop, a blend of exhibition space, design studio, and gallery, is housed in a former warehouse designed in the style of a traditional Japanese tea house. The tactile, inclusive yet exclusive experience at T-House contrasts with the utilitarian approach found at Selfurigi which caters to different clientele. Selfurigi is a growing chain of self-service, unmanned vintage clothing shops that offer another take on vending machine retail. The stores are unmanned, applying an app based, just-walk-out payment system — plus they are open 24/7.

Adaptation

The who, what, and where of shopping has changed in both cities and our construct of retail as a litmus test of a city’s current zeitgeist holds true. Hong Kong’s unique retail charm has dimmed after its integration with mainland China. Tokyo’s retail scene maintains its Japanese essence with a temporary surge in global visitors that we expect will wane. The economy has reaped the economic benefits of the offshore surge while leaving the local consumer class in limbo. If the price of the Japanese Yen rises in 2024 as projected, it should buoy domestic consumer sentiment, supporting a corresponding rebound in the cultural and socioeconomic climate.

As the world writ large begins to coalesce around the idea that there will be no new normal, current Tokyo and Hong Kong zeitgeists reflect a spirit of pragmatic adaptability. Retail ebbs and flows in synchrony with local economies, as we said, it’s the bellwether.