Doing business in Spring 2025 is not for the faint of heart. The recent economic (and other) shockwaves serve as a reminder that the future does not proceed from the past along a neat and projectable trajectory. Until we learn to anticipate disruption and be prepared, we will continue to face new dilemmas that look a lot like today’s as we await the thwack of the descending sledgehammer that is the ever-evolving U.S. tariff gambit. As with the pandemic, the retail industry finds itself stunned by events, sitting ducks exposed to today’s shapeshifting economic caprices while relying on words like “unimaginable” to conceal its unpreparedness.

Could an iconic global retailer like IKEA begin to close stores in the U.S. due to tariff impacts? Might a U.S. company (Wayfair, Walmart, Restoration Hardware) try to create a domestic version of IKEA, or would the domestic tariff advantage be blunted by parts and input tariffs on the manufacturing of goods?

Stunned Paralysis

The tariff churn persists, and some strategists seem paralyzed by its unpredictability. However, our team at The Robin Report has covered the 2025 tariff imbroglio with ongoing reports from different perspectives offering thought leadership, APAC reporting with a keen eye on China, and the U.S. retail perspective, all with insightful analysis.

This report takes a different tack. We are not presenting an action plan or strategic solutions. Instead, we present a systemic analysis of the unintended consequences of the tariffs: what has happened, what may happen next and a range of plausible implications that are worth considering. This is intended to help you think differently about a macro issue (like the tariffs) that may have a dramatic, lasting effect on our economy at large and the retail industry specifically.

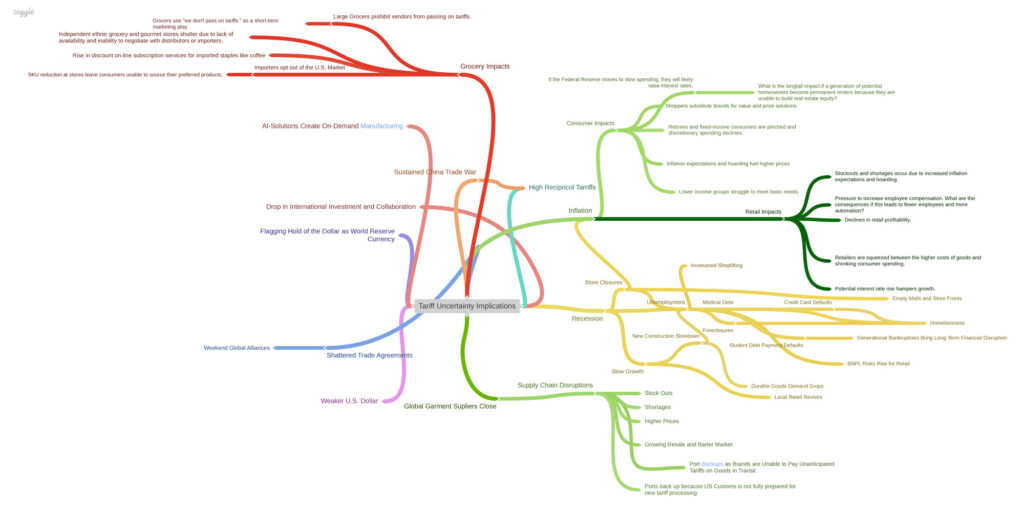

Mapping Consequences

Our map is complicated which is why this report presents it in a simplified format, but it is a systems perspective on how unintended consequences can derail a business and an economy. If you think of the tariffs as an interconnected case of causes and effects, you may become as alarmed as we are.

Breaking It Down

Systems thinking is a required tool for foresight and we are looking at the current economic upheaval through a systems lens. Our mapping is based on three steps.

- Our process starts with today’s macro events

- We then connect these events to retailing and the economy

- Then we drill down to uncover plausible outcomes and what-if questions that may change life in the U.S. as we know it

The process behind this exercise is to help with scenario planning for contingencies. This is not simply an intellectual exercise; it can reveal areas of both vulnerabilities and opportunities. Additionally, if you get in the habit of working through plausible but surprising events, words like unimaginable become erroneous.

Macro Events

We started with the key driver behind the discord roiling retail: the uncertainty caused by the international tariff rollout by President Trump with the three global tariff models:

- Retaliatory tariffs on U.S. exports

- Sustained, stepped-up tariffs on goods both finished, and component parts imported from China

- Varied, shifting, “tailored” tariffs

Next, we looked at the immediate impacts demonstrated in the model and asked what-if questions to reveal their implications:

- Worrying shifts in the U.S. bond market as the 10-year U.S. treasury yield increases indicate anomalous U.S. Treasury sales.

- What if foreign governments are dumping U.S. treasuries because they fear financial instability, or are they retaliating for U.S. tariffs?

- What if institutional and individual investors are dumping U.S. treasuries because they fear financial instability?

- How will the increase in 10-year treasury yields impact the U.S. deficit in 10 years and what might that mean then for the U.S. economy in 2035?

- What if this yield increase triggers interest rate hikes which then increase borrowing costs (think mortgages, auto loans, credit card rates) and inflation and how will that impact retail?

- The strength of the U.S. dollar declines.

- We know this makes imports more expensive for U.S. consumers. What does that mean for retail?

- We know this makes exports less expensive for foreign consumers. How might this impact retail?

- Since a declining dollar + the tariffs make parts that are essential in domestic manufacturing more expensive, what does that mean for U.S. retailers who want to sell U.S.-made goods (think Walmart)?

- Direct foreign investment in the U.S. slows.

- Could an iconic global retailer like IKEA begin to close stores in the U.S. due to tariff impacts? Since we are speculating, might a U.S. company (Wayfair, Walmart, Restoration Hardware) try to create a domestic version of IKEA, or would the domestic tariff advantage be blunted by parts and input tariffs on the manufacturing of goods?

How Macro Events Will Impact the Retail Industry

- What will it mean for retail if the economic trust the U.S. has earned over decades is questioned and the U.S. dollar’s position as the global reserve currency is challenged by the E.U. or China?

- Since the U.S. has broken or altered existing trade agreements such as the USMCA and AGOA (the tariff-free trade agreement with many African nations), will other nations trust any future agreements? If not, how will that affect retail?

- What is the impact of imports from other countries if the 10 percent tariff rate lasts for the entire Trump Term?

- Tariff advertising slump: Should a brand launch an ad campaign for a car that costs $4000.00 more than it did a year ago? Should a brand or retailer plan a Christmas ad campaign for a new toy that will cost up to triple its current price?

- Inbound international tourism drops: What if tourists boycott U.S. travel despite attractive exchange rates?

- Will outlet malls suffer from tariffed goods price increases and decreased tourist footfall?

- Since travel agents specializing in Disney World vacations have reportedly seen a dramatic drop in bookings from Canadian visitors, will that have a ripple effect on retail beyond Disney?

- Imports from China begin to vanish as tariff rates create a de facto trade embargo.

- Will Americans begin buying products directly from Chinese factories in an attempt to avoid tariffs?

- Since 5 Below has already stopped importing goods from China, will U.S.-produced goods stock the empty shelves? Or will the tariffs nullify the store’s pricing strategy and thus eliminate its competitive advantage?

- Bloomberg and WSJ report that Amazon is starting to cancel orders from Chinese suppliers; does that mean many essential items will be unavailable to U.S. consumers? How will consumers respond?

- Businesses slow or halt investments in the U.S. due to tariff uncertainty.

- Microsoft halts a planned $1 billion investment in an AI data center in Ohio after tariffs are announced. This means many planned jobs will never materialize. Is this a sign of a coming recession?

- Stellantis lays off workers in the U.S. and halts production in Mexico and Canada. What is the impact on retail in the affected communities? What is the impact on car sales in the U.S.?

- Walmart issues a rare mid-quarter warning on tariff losses. What if Walmart starts laying off workers? Will they begin using more automation in stores? Will customers care if Walmart continues to offer good value?

- BNPL firm Klarna puts planned IPO in the U.S. on hold. Is this another sign of an impending recession?

Consequences for Retail and the Economy

Next, we moved to informed speculation and looked for plausible, potential consequences of the global tariffs. We broke those into two buckets, recession and inflation. Within the two buckets, we broke recession into consumer impacts and retail industry impacts and dug in from there.

- Recession and Unemployment

- Student debt defaults. As the pause in student debt repayments ends, what are the longtail consequences of damaged credit ratings for large numbers of millennials and Gen Z. consumers who can’t make the payments as unemployment rises? Will enrollment in higher education decline? Will we have enough educated leaders for the future?

- Loss of health insurance. Since our health insurance system is tied to employment, what if medical debt and personal bankruptcies cause sustained financial hardship and long-term decreased spending?

- Credit card defaults. What if there are large numbers of personal bankruptcies and how could that impact retail?

- BNPL defaults. What if the lending platforms collapse under the weight of unpaid debt?

- 401K and IRA and investment portfolios shrink. What if the declines shatter the “Wealth Effect” psychology? Will wealthier consumers cut back on discretionary spending?

- Food and housing insecurity. How will local crime accelerate? How will society become more polarized between the haves and have-nots?

- Drop in new housing construction. Drop in demand for durable goods. What would this mean for Best Buy, Home Depot or Restoration Hardware?

- Retail closures, consolidations, bankruptcies. Profitability declines, layoffs and retail real estate glut with the rise of mall vacancies. Can malls reinvent themselves again?

- Shareholder pressure forces new platforms for resale and barter.

- What if in-store crime increases? Will shoppers reject in-person shopping again? What will this mean for local retail?

- Inflation

- Retirees and fixed-income consumers are pinched and discretionary spending declines.

- Inflation expectations can cause hoarding of essential items (think toilet paper) which generally drives prices higher.

- Shoppers substitute brands for value and price solutions.

- Lower income groups struggle to meet basic needs.

- Interest rates increase if the Federal Reserve moves to slow spending. What is the longtail impact if a generation of potential homeowners become permanent renters because they are unable to build real estate equity?

- Declines in retail profitability.

- Countries could stop exporting their foods and beverages to the U.S. This could lead to an SKU reduction at the grocery store. What if customers can’t get their Kerrygold butter or aged Parmigiano Reggiano cheese? Will consumers shift to domestic substitutions or take the tariff hit through specialty retailers?

- Pressure to increase employee compensation. What are the consequences if this leads to fewer employees and more automation?

- Retailers are squeezed between the higher costs of goods and shrinking consumer spending.

- Small-footprint ethnic grocery and gourmet stores may be forced to shutter due to the lack of availability and inability to negotiate with distributors or importers.

- Stockouts and shortages occur due to increased inflation expectations and hoarding.

- Potential interest rate rise hampers growth.

- Freight shippers cancel or delay transit as volume drops.

- Importers scramble to find new suppliers as factories close.

- Ports back up because U.S. Customs is not fully prepared for new tariff processing.

- Ports back up as importers can’t pay fluctuating tariffs on already shipped goods.

- As fewer ships arrive in ports, trucking companies and distribution centers could face impending crises, forcing staff cuts, increased reliance on automation, consolidation with competitors, or failure.

- High costs may drive innovative solutions: AI inventory and on-demand manufacturing technology may increase efficiencies and reduce waste.

- Shoppers find discounted alternatives to grocery stores as online subscription services for imported staples like coffee pop up.

Working Through

We encourage you to construct your own unintended consequences scenario planning to identify the hidden dangers and long-term impacts of today’s events. As the churn continues, the risk of stunned paralysis remains at code red unless you build a permission structure that empowers your teams to imagine the unintended consequences of change. Use findings as a foundation for analysis and in the process, you may discover insights previously blocked by common assumptions and groupthink. If you shift your culture to anticipating the future, you may avoid those unintended consequences.