The National Retail Federation (NRF) is out with its Halloween spending 2024 forecast and predicts it will amount to an $11.6 billion spending holiday. Across the nearly 8,000 consumers sampled, costumes and decorations will account for the largest share of purchases, $3.8 billion each, followed by candy ($3.5 billion) and greeting cards ($0.5 billion). “Halloween marks the official transition to the fall season for many Americans, and consumers are eager to get a jump start on purchasing new seasonal décor and other autumnal items,” NRF Vice President of Industry and Consumer Insights Katherine Cullen said.

Consumers are worried about the job market as they remain challenged to cover the continuing high costs of necessities. The Conference Board Consumer Confidence Index fell some seven points in September with its Present Situation Index measuring consumers’ assessment of current business and labor market conditions off over ten points. The fact that the BLS revised its previous 12-month job number down by 818,000 in August didn’t help.

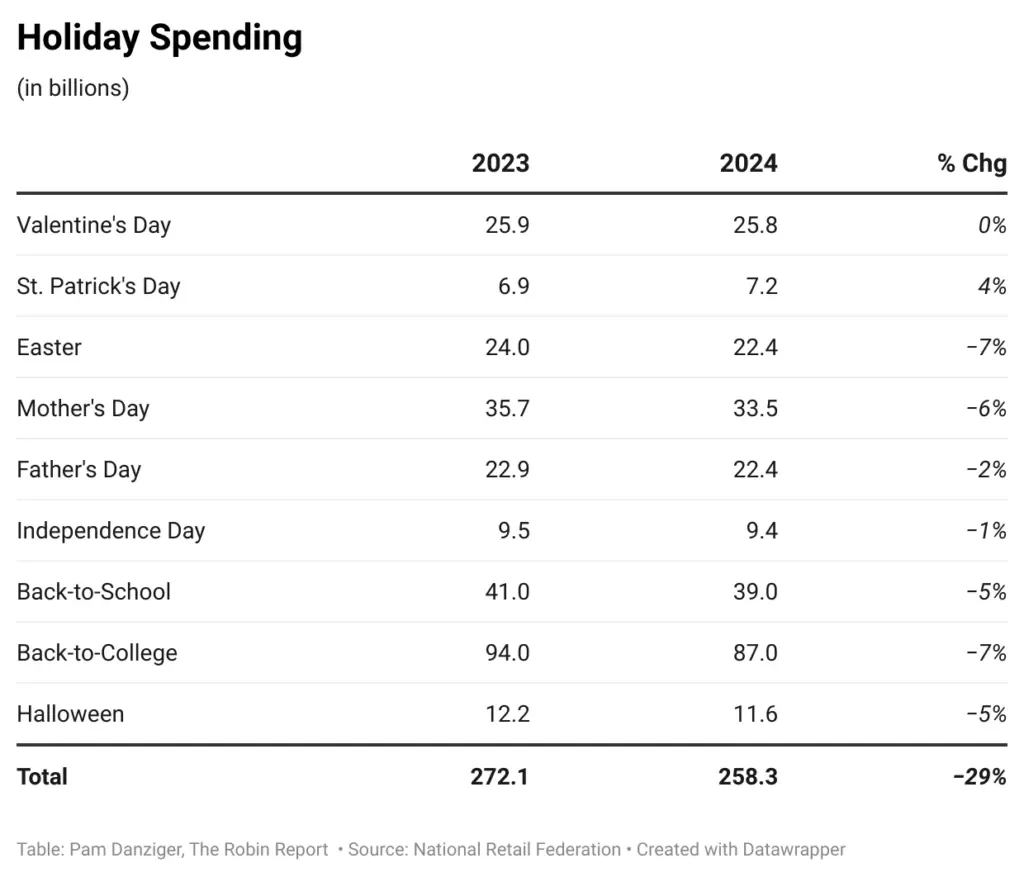

Halloween begins the leadup to the much-anticipated winter Holiday season for retailers, so it is often a bellwether for how the rest of the year will go. And if that’s any indication, retailers are going to find more tricks than treats in store in the months ahead. Halloween spending 2024 will drop 5 percent from last year’s $12.2 billion.

Boo: Holiday Forecasts Off

Throughout the year, the NRF provides retailers with an early look at each holiday on what and where consumers expect to spend. Chief economist Jack Kleinhenz, PhD, factors in other economic indicators to the Winter Holiday Forecast providing an economically reliable prediction for consumer retail spending through November and December. NRF’s other holiday forecasts, including the recent Halloween numbers, are less stringent. The big difference is that it is an early guide to what consumers plan to do, but not what they actually do.

In effect, NRF’s other holiday forecasts measure consumer sentiment surrounding holiday gifting and celebrations. And throughout this year, those sentiments have been way down compared with last year.

With two early-year exceptions – Valentine’s Day flat and St. Patrick’s Day up – expected spending on all the other 2024 major shopping holidays will be off. When totaled up, consumer sentiment around discretionary holiday celebrations was down 29 percent from last year. Inflation has weighed heavily on American consumers, so they are spending more – much more – on household necessities, leaving less money available for discretionary purchases, like those surrounding holidays.

Yet holidays are a measure of how people feel. They are celebrations people anticipate and look forward to. And by that measure, consumers are signaling a general malaise and lack of optimism.

Malaise Ascending

Though inflation is significantly down from rates set early in the post-pandemic period, prices are still some 20 percent higher in most spending categories. In fact, only about 6 percent of the nearly 400 items tracked by the Bureau of Labor Statistics (BLS) are cheaper now than they were back then, according to Bankrate.

Taking the biggest bite out of household budgets since January 2020 are:

- Grocery food prices up 25 percent, with meat (28 percent), dairy (20 percent), fruits and vegetables (17 percent) and sugar and sweet indulgences (29 percent) up the most.

- Housing, with rent up 25 percent and the high costs for buying a home is keeping renters on the sidelines.

- Car-related expenses have climbed precipitously. Despite gas prices down this year, filling up the car still costs 28 percent more than in January 2020. Auto insurance has gone through the roof, up 50 percent, and the cost of buying or leasing a vehicle has also risen – up 19 percent for a new car, 23 percent for a used car and 34 percent for leasing a vehicle.

Weakening Job Market

Consumers are also worried about the job market as they remain challenged to cover the continuing high costs of necessities. The Conference Board Consumer Confidence Index fell some seven points in September with its Present Situation Index measuring consumers’ assessment of current business and labor market conditions off over ten points. The fact that the BLS revised its previous 12-month job number down by 818,000 in August didn’t help.

“The deterioration across the Index’s main components likely reflected consumer’s concerns about the labor market and reactions to fewer hours, slower payroll increases, fewer job openings—even if the labor market remains quite healthy, with low unemployment, few layoffs and elevated wages,” The Conference Board’s chief economist Dana M. Peterson said in a statement.

That troubling assessment of the labor market was also noted by NRF’s Kleinhenz, who described the labor market as “not terribly weak” – as opposed to positively strong –emphatically asserted it is showing signs of “tottering.” In his September update, he further reported that while overall consumer spending was up five percent in July, disposable personal income (i.e., income after taxes) only rose 3.6 percent.

Debt and Delinquencies

To cover rising costs, consumers keep adding to their household debt, up $108 billion in the second quarter to a record $17.8 trillion, according to the Federal Reserve Bank of New York. Mortgage debt accounts for the largest share ($12.5 trillion) but auto debt ($1.6 trillion) and credit card debt ($1.1 trillion) also are big contributors.

In addition, serious delinquencies in debt repayment are on the rise. Some nine percent of credit card and eight percent of auto loan balances transitioned into delinquency in the second quarter. Credit card debt, the financial source cash-strapped shoppers frequently turn to, can be particularly costly because interest rates are high and variable, often exceeding 20 percent.

Mixed Signals

McKinsey and Company’s third quarter ConsumerWise survey among 4,000 U.S. consumers shows just how hard it is to get a bead on consumer sentiment. Reporting that there was a “boost in optimism” in the survey conducted in late July-early August – which went south in September – McKinsey found age was the primary determining factor in their level of optimism. Younger Gen Zer’s and millennials, no matter their income, were more optimistic than more mature Gen X and boomers.

Yet, McKinsey also found that the more optimistic the younger cohort is, it is also the most price sensitive. While all consumers (76 percent) across the board reported trading down to save money, Gen Z and millennials are trading down at a much higher rate, 86 percent, and nearly half of that youthful cohort have changed retailers for lower prices or discounts.

So, if retailers are counting on younger generations to run a victory lap of spending this holiday season, they better be ready with outsized promotions to make up for flagging confidence among more mature consumers. The Conference Board noted that September’s decline in consumer confidence was most pronounced among the 35-to-54 age group, consumers who tend to have the most money to spend on discretionary purchases.

McKinsey warns, “As keen market watchers already know, emerging economic indicators could dampen this newfound confidence. The next few months may be turbulent. Market uncertainty, the upcoming U.S. general election and ongoing geopolitical conflicts may test U.S. consumers’ faith in the economy.”

And another wildcard to throw into the mix: a pending strike by the International Longshoremen’s Association that could impact six of the ten busiest U.S. ports. The ports could close down on October 1 if a new contract is not in place, threatening retailers’ shipments for holiday merchandise. Although many inbound container ships have been diverted to other ports that a strike won’t impact, it could still cause significant backups and increased shipping costs, ultimately contributing to inflation.

Glass Half Empty

Last year, NRF predicted that Winter Holiday 2023 spending would grow between three and four percent over 2022. They hit it on the nail, with retail sales up 3.8 percent to $964.4 billion in November-December, excluding automobiles, gasoline stations and restaurant food service. And nobody needs to be reminded that last year’s increase can largely be attributed to inflation.

While the NRF has yet to announce its Winter Holiday forecast, it predicted core retail growth for 2024 in the 2.5 to 3.5 percent range to reach between $5.23 trillion and $5.28 trillion. Not so fast: In August, core retail was up only 1.5 percent, totaling $3.33 trillion over $3.28 trillion in 2022, about half of what was expected.

So, consumers will need to really step up through the rest of the year to hit NRF’s year-end marks, which is looking increasingly unlikely given the recent downturn in their confidence. Early in the year, NRF’s Kleinhenz said, “It’s hard to be bearish on the consumer.” However, I don’t agree and feel bears are on the move and will keep taking bites out of the consumer’s willingness to spend.