Over the past two years, buy now pay later (BNPL) services have rapidly gone mainstream in the United States. As recently as 2019, U.S. BNPL payment volume totaled just $3 billion. That rose to an estimated $55 billion last year. Many prognosticators expect this momentum to continue for the foreseeable future.

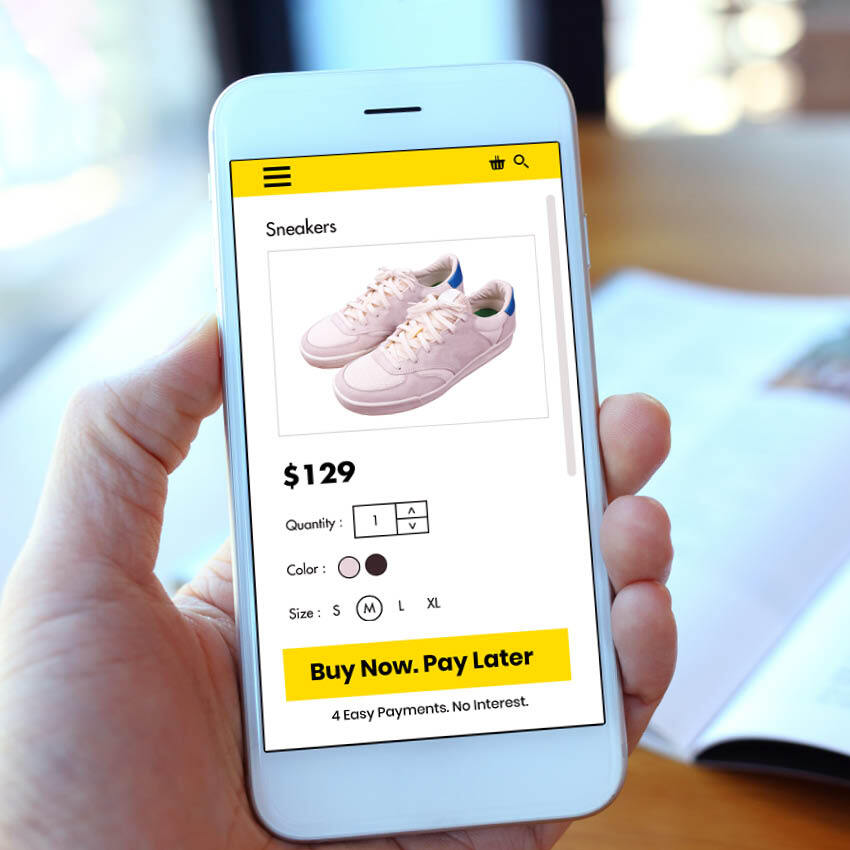

BNPL has become a go-to payment method for younger consumers (particularly millennials and Gen Z) during the Covid-19 pandemic. Merchants have eagerly partnered with BNPL platforms to appeal to these cohorts. BNPL has become especially ubiquitous for ecommerce but is also gaining traction as an in-store payment method.

Despite rapid adoption during the pandemic, the benefits for merchants and the long-term financial sustainability of the BNPL model in the U.S. remain dubious at best.

Major BNPL platforms claim that their services have a host of benefits for retailers, including higher conversion, larger basket sizes, easier customer acquisition, lower return rates, and less fraud. Nevertheless, retailers should be wary of becoming too reliant on BNPL financing. Despite rapid adoption during the pandemic, the benefits for merchants and the long-term financial sustainability of the BNPL model in the U.S. remain dubious at best.

Higher Fees

The most obvious drawback of adopting BNPL as a payment option is that acceptance costs tend to be much higher than traditional payment methods.

The Kansas City Fed reports that BNPL merchant fees can range anywhere between 1.5 percent and 7 percent. At the low end of that range, BNPL would be a great deal for merchants. However, that reflects promotional pricing rather than long-term costs. More typically, the BNPL platform takes a 4 percent to 6 percent cut. Credit card fees average roughly half of that level, and debit transactions cost even less.

It’s no surprise that merchants must pay such high fees. BNPL firms allow users to pay in four equal installments (most commonly 25 percent down followed by three more payments over the next six weeks) with no interest or fees if all payments are made on time. The merchant fee must cover their financing costs and compensate them for the risk that customers default on their payments. By contrast, credit card companies bank on earning high interest income from users carrying a balance from month to month, allowing them to make money despite lower swipe fees. Debit card fees are even lower, as debit transactions carry no credit risk.

Is the Sales Lift Real?

With some notable exceptions, retail is a notoriously low-margin business. So why are so many retailers willing to pay BNPL fees that can be twice as high as credit card acceptance fees?

The main reason is that they hope for meaningful incremental sales volume. RBC Capital Markets estimates that offering BNPL can boost conversion by 20 percent to 30 percent while also increasing basket size by 30 percent to 50 percent. The midpoint of those ranges implies a 75 percent spending lift.

While other data sources point to a smaller benefit, there’s broad agreement that by making it easy to spread out spending, offering BNPL reduces cart abandonment and encourages consumers to make bigger purchases.

Yet some things don’t add up. First, many BNPL firms boast that they help people spend responsibly to avoid debt. But spending responsibly ultimately means spending less than those consumers would have spent if they were using credit cards.

Second, consumers who report that they live paycheck to paycheck represent more than half of BNPL users, according to a recent study by PYMNTS and Amazon Web Services. Similarly, a poll by The Ascent found that the most popular reason for using BNPL was to make purchases that did not fit in respondents’ budgets.

It stretches credibility to argue that the ability to pay over six weeks with a BNPL program can enable huge increases in consumption by consumers who live paycheck to paycheck. It’s also worth pointing out that credit cards offer five weeks of interest-free financing on average if you pay your balance in full on the due date. The availability of BNPL may enable a consumer to make a bigger purchase on any given day, but the resulting payments would cut deeply into their spending power over the next six weeks, potentially reducing future sales.

Third, teasing out the impact of BNPL on consumer spending isn’t straightforward. BNPL didn’t take off in the U.S. until 2020. Retail spending has surged since then (especially online retail, where BNPL penetration is higher), helped by factors such as government stimulus payments and reduced travel spending. Studies may be misattributing the sales lift from consumers having more spending power to BNPL. Additionally, the finding that BNPL boosts basket size may be spurious if consumers group purchases that they would have otherwise made separately or strategically use BNPL for larger items that they would have bought anyway.

In theory, it should be possible to control for these variables to discover the true impact of BNPL on sales. Unfortunately, most of the “research” on BNPL appears to be little more than a marketing exercise and overlooks such details.

A Questionable Business Model

Looking forward, the financial sustainability of BNPL is highly suspect. To be sure, some consumers use BNPL responsibly as a budgeting tool to smooth out their spending. However, for many users, BNPL appears to enable overspending.

For example, The Ascent’s poll (linked above) found that 31 percent of respondents had made at least one late BNPL payment. And 36 percent of prospective BNPL users said that they were at least somewhat likely to make a late payment over the next year. Thus, rising delinquencies are a major risk for BNPL firms.

BNPL advocates counter that the delinquency rate remains quite low. They assert that most of the apparent increase in delinquencies merely reflects the sector’s rapid growth. But delinquency rates for all kinds of debt are hovering near historic lows. The home foreclosure rate hit a record low in December, the percentage of serious mortgage delinquencies is nearly 50 percent below pre-pandemic levels, and auto loan delinquencies remain well below pre-pandemic levels despite surging loan balances.

Over the past two years, Americans have benefited from aggressive fiscal stimulus measures. Most middle-class and lower-income Americans qualified for three rounds of stimulus payments totaling up to $3,200 per adult and $2,500 per child. Generous supplemental unemployment benefits helped borrowers navigate temporary job losses. And in the second half of 2021, the IRS provided monthly payments to parents of children 17 and under, effectively providing a free advance on their upcoming tax refunds.

The average BNPL balance is under $250, so it’s no surprise that delinquency rates have been low over the past two years in light of this government largesse. With stimulus efforts winding down and inflation driving up basic living expenses, delinquencies could quickly become a big problem for the nascent U.S. BNPL industry.

On the bright side, retailers don’t bear the cost if customers ultimately default on their payment plans. Yet retailers that become too reliant on BNPL to drive growth could see sales slow abruptly if BNPL firms become more selective about offering financing. That could indirectly lead to losses (e.g., if merchants order too much inventory and have to offer deeper clearance discounts).

The Jury Is Out

In an extremely optimistic scenario, the rise of BNPL could drive U.S. retail sales sustainably higher by providing short-term financing to people who can’t qualify for credit cards and by reducing the amount spent on credit card interest payments. Alternatively, by making it easy to access credit, BNPL could be encouraging consumers to buy things they can’t afford, setting up the industry and its customers for financial distress down the road. That’s a big reason why the Consumer Financial Protection Bureau has opened an inquiry into the BNPL sector.

To prove that it is financially sustainable for both users and providers, the BNPL industry must survive a full credit cycle. With delinquency rates already creeping up even though household balance sheets remain quite strong by historical standards, the odds don’t look particularly good.

This doesn’t mean that merchants should shun BNPL altogether. Taking calculated risks is a fundamental part of being in business. But adding BNPL options can’t be a primary growth strategy. Retailers that become too dependent on this new credit tool to drive sales could find themselves in dire straits if rising defaults in the future force the BNPL industry to cut back dramatically on financing new purchases.