Editor’s note: This report is part of TRR’s series of explorations and analysis of the unintended consequences of what is taking place geopolitically and socio-economically that will shape the future of retail. Our Foresight expert, Sarah Holbrook, uses a sophisticated systems mapping tool to reveal how current events influence retail. We recommend it as insight into how to anticipate the future and proactively plan. It’s complex and complicated, but has deep implications and impacts on the American consumer and retailing writ large.

The August 19 Congressional Budget Office (CBO) report spawned a series of eye-popping headlines: “Tariffs Will Lower Deficits by $4 Trillion Over a Decade.” But when you read past the headline, you will find a striking caveat; the projected savings only materialize “if the higher tariffs persist for the 2025‒2035 period.” Wait a minute! The tariffs have fluctuated capriciously since April and are anything but persistent, not to mention that 2035 is a decade away.

Complicating the matter is our American democracy system, where power tends to shift in two-, four-, or eight-year intervals, and policies move accordingly. One might reflexively dismiss this report as political theater, assuming the current tariffs are short-lived. Yet a plausible alternative is that they stick around, possibly for the decade. Then what? There are unintended consequences for the retail industry. Here’s how.

The question is no longer if the economic uncertainty spurred by recent government initiatives will dampen retail activity; the real questions are: by how much, and for how long?

Tariff Takedown

While most of the tariffs are under legal scrutiny, our working assumption is that barring decisive action against them in the Supreme Court, the current tariff structure persists for the remainder of the Trump Administration, and potentially beyond. These broad-based tariffs are a powerful economic stressor, but they are one among a range of destabilizing initiatives that will likely suppress discretionary spending across economic ranks. Additional pressure points include the immigration crackdown, a weakening social safety net (including Medicare and Medicaid cuts), high housing, energy, and private insurance costs, healthcare cost increases, a frozen job market for many, an aging population, and rising numbers of working parents exiting the labor force, whether voluntarily or due to government layoffs and dismissals. The question is no longer if the economic uncertainty spurred by recent government initiatives will dampen retail activity; the real questions are: by how much, and for how long?

The Unintended Consequences Model

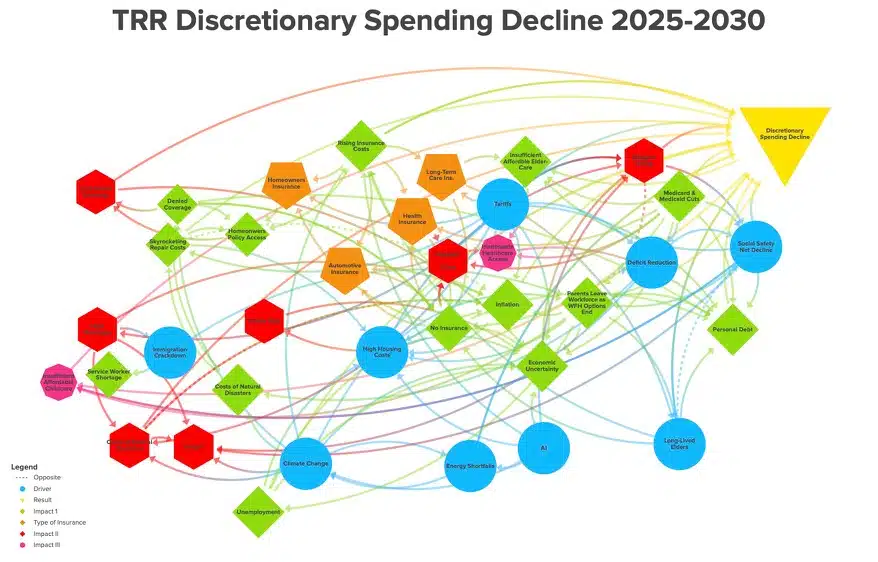

To explore the economic turbulence, we built a visual model of the recent initiatives, searching for the unintended consequences and plausible impacts of the government actions on discretionary spending in retail. Our horizon is medium- to long-term. We don’t consider current stock market activity, which has been unstable although generally positive in 2025, but decidedly short-term. Our map is complex and can be difficult to decipher, as befits the circumstances. But stick with us!

We simplified our findings by interpreting the map conservatively. It is obvious that all arrows point to a contraction in discretionary spending for the years 2025 (beginning Q-4) through 2030 for most U.S. consumers. This is a serious red flag for retailers since consumer spending is the lifeblood that powers this economy, accounting for nearly 70 percent of annual GDP.

Breaking the Map Down

Systems thinking is a required tool for foresight, and we are looking at the current economic turbulence through a systems lens. Our mapping follows three steps.

- We begin by exploring the macro-forces and government interventions that are driving change and map the intersections.

- We observe the singular and combined effects of the forces and interventions, then consider the first, second, and third-order impacts or implications.

- We connect these events and implications to retailing and apply commentary to advise readers’ strategy.

The process behind this exercise is designed to help with scenario planning for contingencies. This is not simply an intellectual exercise; it can reveal areas of both vulnerabilities and opportunities.

Macro Events and Government Interventions

Taken in total, the drivers of change (the events and interventions listed) are not isolated; they intersect and collide, setting off a cascade of implications.

- Macro Events

- Climate Change

- Artificial Intelligence

- Energy Shortfalls

- High Housing Costs

- Long-Lived Elders

- Government Interventions

- Immigration Deportation Policies

- Tariffs

- Social Safety Net Decline

- Push for Deficit Reduction

Interconnected Context

Now we connect the macro events and government actions to reveal the unintended consequences of their causes and effects.

- Global climate change intersects with the deportation policies in the United States. In California, crops are rotting on trees, vines, and in fields as ICE enforcement and deportations create a labor crisis, food shortages, hunger, and rising produce prices.

- Rising prices intersect with the shrinking social safety net as SNAP benefits are curtailed along with other measures designed to offset the expense of the latest round of tax cuts.

- Shrinking yields due to both droughts and floods spur rising commodity costs, stressing retail margins and driving inflation

- Strained energy supplies, already under pressure from the soaring demand for artificial intelligence services, struggle as demand for cold storage rises to protect harvested produce from spoilage. Energy prices spike.

- While many grocers, restaurants, and suppliers have been slow to increase prices due to tariffs, that is changing.

- The Peterson Institute reports that as of June 2025, the funds raised by the tariffs amounted to nearly $94 billion. As the sums continue to rise, the calls for deficit reduction will increase. It will be tempting for Congress to legislate a tariff program into law.

- Extreme climate events aggravate already high housing prices as insurance and repair costs skyrocket.

- As the population ages, benefit outlays further strain the social safety net. Additionally, the costs of long-term care will be impacted by immigration deportation policies, which are already causing a shortage of health aids. This service worker shortage is likely to push up wages for the available labor pool.

- Rising costs increase debt for both elders and their offspring while reducing generational wealth transfers.

Cascading Results

When we explore further implications of the drivers, we begin to understand the impacts on the pocketbooks of most consumers:

- Sluggish hiring continued in August as the U.S. added only 22,000 jobs, according to the Bureau of Labor Statistics. While the decline may increase the odds of a cut in borrowing rates, the anemic hiring figures reflect a climate of economic uncertainty. NYT reports, “Underscoring the report’s weakness, the job search platform Indeed flagged that employment growth over the year to date is the lowest it’s been since 2010.

- The share of parents with young children in the workplace has fallen by more than three percentage points in the first half of 2025, according to recent reporting from the Bureau of Labor Statistics. The Washington Post’s Economics Correspondent Abha Bhattari comments on this decline: “A leading factor in women leaving the workforce is the end of pandemic era flexibility, which lured many women back into the workforce with policies that allowed for daycare drop-offs and doctor’s appointments. Since January, there has been a push for strict return-to-office policies by both private companies and the government. Women with children five and under often need the most flexibility. Additionally, the sweeping Federal workforce cuts have disproportionally impacted women, and particularly black women.”

- While the Medicare and Medicaid cuts legislated as spending offsets in the recent tax legislation won’t be imposed until 2027, they will present a significant drag on discretionary spending toward the end of the decade.

- Other factors that influence sluggish hiring include the steady integration of AI into the workplace, and high housing costs. High housing costs limit worker mobility, deterring candidates from seeking employment in high-income, high-cost cities that could offer better candidates to the employer and greater opportunity for the candidate.

Charting Retail’s Future

Other nodes in our map reveal a cascade of complex outcomes, each contributing to a significant contraction in discretionary spending. Inflation hovered tantalizingly close to the Federal Reserve’s 2 percent target when the current tariff regime took hold. Now, it’s climbing again, amplified by initiatives that have ushered in a period of destabilizing uncertainty. The plausible outcome? Many consumers will feel poorer; many more will be forced to spend less.

The immediate questions are clear: By how much, and for how long? But the more strategic questions involve preparation; how to confront these challenges and uncover opportunities for your business. Scenario analyses tailored to your organization, built on the drivers outlined here, are a critical starting point. While markets may reflect short-term sentiment, consumers are already bracing for long-term impact. Do the hard foresight work now to keep your business airborne and to help sustain the economic circulatory system that our industry depends on.