Once the company now known as QVC Group had a lot going for it. In 2017, when it acquired HSN to consolidate its lead in the television shopping market, it was number one in video commerce. iMedia, which operated under Evine, ShopNBC and ShopHQ, wasn’t even close and has since gone under. And more significantly, QVC was number three in ecommerce. But that was then, this is now: QVC is hanging on by a thread.

QVC turned its attention to the over-50 crowd in an “Age of Possibility” campaign that launched in April 2024 with a Las Vegas Q50 Summit. It showcased 50 distinguished women of a certain age sharing inspiring stories, including Christina Applegate, Queen Latifah, Naomi Watts, Patti LaBelle, Rita Wilson, Kathie Lee Gifford, Billie Jean King and Martha Stewart.

Trouble in TV Shopping Land

QVC revenues peaked at $12.5 billion in 2020, adjusted for the sale of Zulily in 2023, and have fallen ever since, down to $10 billion in 2024 and off another 10 percent in the first quarter ended March 31. Customer counts have dropped from 11.6 million at the end of 2020 to 7.4 million this year. And most recently, QVC’s share of new customers has fallen by almost half, from 48 percent in 2020 to 25 percent most recently.

Not one product category has delivered positive growth since 2023. Electronics has been the biggest loser, dropping 20 percent in 2023, 13 percent in 2024 and 18 percent in first-quarter 2025. Home – QVC’s largest reporting segment with just under 40 percent of sales – along with apparel, and jewelry sales declined by low single digits throughout 2023 and 2024. However, in the first quarter this year, both home and apparel sales losses increased to 9 percent, while jewelry sales dropped even further by 21 percent. Beauty and accessories were off by high single digits in 2024, and both have crossed over to low double-digit losses so far this year.

Can’t Change the Tide

QVC bought some time selling off Zulily in May 2023 ending that year with $10.9 billion in revenues and $590 million operating income – but that didn’t hold for long as operating income plunged to an $809 million loss in 2024. So earlier this year it remediated.

- In late March, QVC laid off some 900 employees, about 5 percent of staff, and relocated the HSN studio and broadcasting hub from St. Petersburg, FL to QVC headquarters in West Chester, PA.

- After a reverse stock split in May this year, it chose to voluntarily delist from the Nasdaq Capital Market effective May 27 and has applied for its stock to be listed on the OTCQB Venture Market.

Even so, Fitch recently downgraded QVC’s credit rating from “B” to “B-.“ It foresees continued “ongoing topline headwinds” and projects revenues to fall another 5 percent this year, which raises “concerns about the timing and degree of long-term operating stability.”

Fitch may be underestimating QVC’s projected decline this year, given its track record of losing customers and not having a pipeline to replace them. Tariffs will also weigh heavily on QVC since nearly 50 percent of its products are sourced from China.

“If tariffs persist at the current elevated levels, it is our expectation the market will likely see lower consumer demand, particularly in discretionary retail,” QVC CFO Bill Wafford said in the first quarter earnings call. While it pursues finding new sources of supply and negotiations with vendors, QVC prices are bound to increase as the year progresses.

QVC Is Showing Its Age

Although QVC maintains that its customer base includes shoppers of all ages, its core demographic remains middle-aged women. The common perception is that TV shopping is a pastime for older folks. Accepting, even admitting to that reality, QVC turned its attention to the over-50 crowd in an “Age of Possibility” campaign that launched in April 2024 with a Las Vegas Q50 Summit. It showcased 50 distinguished women of a certain age sharing inspiring stories, including Christina Applegate, Queen Latifah, Naomi Watts, Patti LaBelle, Rita Wilson, Kathie Lee Gifford, Billie Jean King and Martha Stewart.

“QVC has a longstanding relationship serving the 50+ customer, and we’re uniquely positioned to launch this dedicated effort that we hope will spur a cultural shift in attitude and behavior towards women over 50,” said Annette Dunleavy, QVC vice president of brand marketing, as she explained that after age 50, women feel largely invisible in the marketplace.

Specifically, a survey conducted by YouGov among nearly 4,000 women found that only 31 percent of women aged 50-to-70 feel supported by brands, compared to nearly 60 percent of women between the ages of 18 and 29 and 41 percent of women aged 30-49.

“QVC is making it our mission to champion women over 50 and build a community and platform where they can come together to share their experiences and celebrate who they are. We are proud to be one of the first mainstream brands stepping up in this way to show dedicated support and celebration for this chapter in women’s lives,” she continued.

It sounds like a worthy cause, but it clearly didn’t move the needle in sales, so QVC came back with a reboot in May. This time, the Age of Possibility event took place in Santa Monica, CA, and it was livestreamed on TikTok. It also focused more on the possibilities of QVC shopping than on the existential possibilities of aging. Yet, if generating sales to women over 50 was the goal, TikTok was an odd choice as a streaming partner. Some 70 percent of TikTok users are under 35, and a mere 14 percent are 45 years and older.

QVC’s Live Streaming

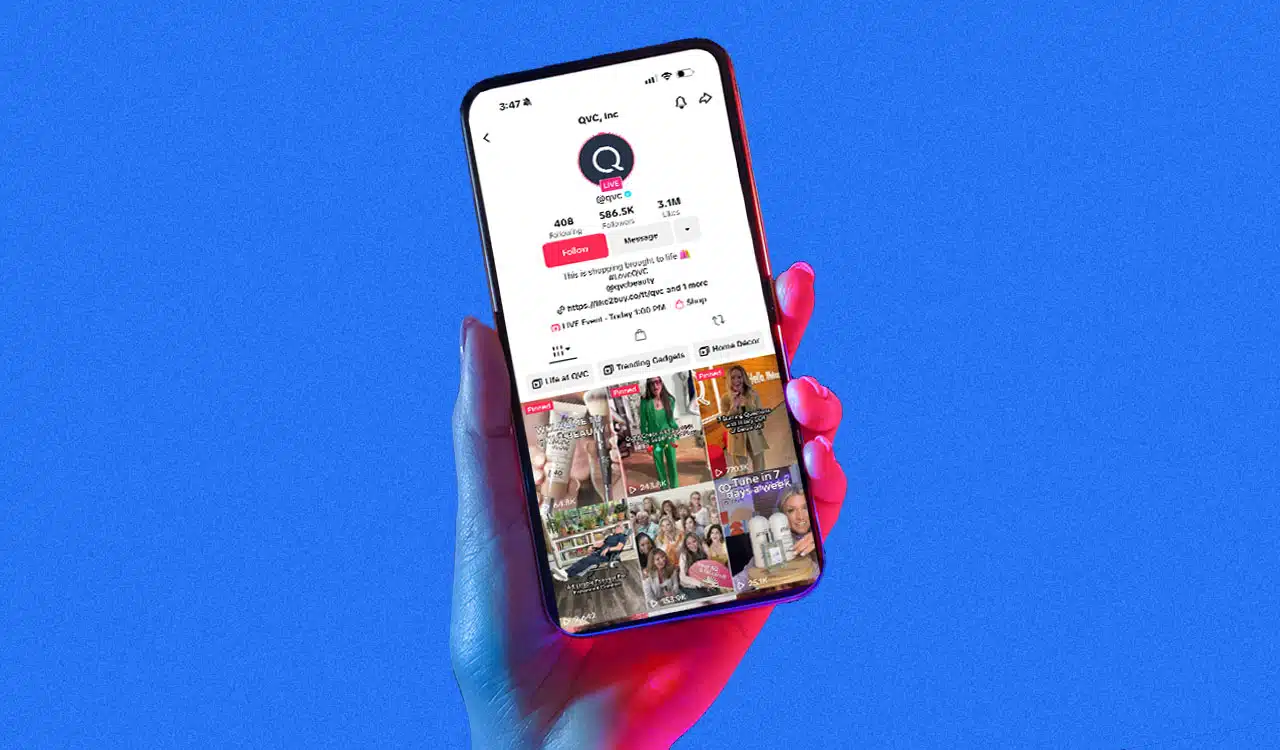

Video streaming is upending traditional cable and broadcast media; Nielsen reports streaming is the top choice for American viewers, used by 44 percent of households in April 2025, against 25 percent for cable and 21 percent for broadcast television. QVC is eyeing live-streaming social commerce as its path to the future with TikTok as its premiere chosen partner. That said, it currently has a QVC Live platform on Facebook and plans are in the works to extend QVC live streaming across YouTube TV, Hulu and Netflix.

QVC first launched on TikTok Shop in August 2024 and now claims some 74,000 TikTok creators have featured QVC items on their shoppable videos and livestreams. It also offers original content created exclusively for TikTok Shop, unlike on Facebook, where it repurposes its regular broadcast segments.

“We are uniquely suited to bring our large-scale, high-volume, live social shopping experience to TikTok,” QVC CEO David Rawlinson II shared, adding that QVC is the original innovator of live shopping and produces more live shoppable content than anyone else – some 49,000+ hours per year. Our agreement [with TikTok] will be a catalyst to transform shopping and discovery, not only for QVC Group but also for social shopping at large,” he continued. As social media channels go, TikTok ranks as the world’s fifth largest, behind, in reverse order, WhatsApp, Instagram, YouTube, and Facebook at number one.

TikTok’s Uncertain Future

Since TikTok Shop launched in the U.S. in September 2023, Capital One reports that Americans spend an estimated $32 million per day shopping on TikTok. Overall, TikTok Shop’s gross merchandise value reached $33.2 billion globally, with the U.S. being its largest market, accounting for approximately $9 billion in GMV.

Of course, Congress passed a law, and the Supreme Court upheld a ban on TikTok in the U.S. unless Chinese-owned ByteDance sells the platform to an American company. President Trump issued an executive order extending the ban timeline, but a deal has yet to be made.

Despite the uncertainties surrounding TikTok’s future, QVC remains optimistic. “While we can’t speculate on the exact outcome between the U.S. government and TikTok, we believe there will be a path forward for TikTok in the U.S., given that 170 million people use the platform,” a QVC spokesperson shared with me.

Losers Win

Overseeing QVC’s growth strategy across social selling, streaming, and digital is Alex Wellen, the newly appointed president and chief growth officer. Wellen, who holds a law degree from Temple University, brings a wealth of media experience, most recently CEO of MotorTrend Group, and before that, 13 years with CNN and two as executive producer with the New York Times. But Wellen has no retail experience, just like Rawlinson, who joined QVC from NielsenIQ.

Perhaps in the world of live-stream social commerce content, how you sell, comes before what you sell. But simply changing platforms from linear broadcasting to social media channels won’t fix the underlying problems at QVC.

In the TV shopping landscape, QVC perfected a winning formula, blending persuasive, well-trained veteran hosts with captivating brand storytellers as guests presenting compelling merchandise. That formula created a genuine connection with the audience and product sales followed.

For example, David Venable, host of the “In the Kitchen with David” show, was QVC’s highest-paid host, earning $500,000 last year. Entrepreneur Kim Gravel serves as both the host of her own Saturday night show and the representative of her $1 billion fashion, beauty, and home business that launched on QVC in 2016. Her brand was the first to sell over $250 million in one year on QVC.

Yet, for every winner like Venable and Gravel, there appear to be more losers, as the company’s numbers indicate. QVC has more work to turn around its business than just switching to live-streaming platforms, like TikTok, as Fitch observed in its recent ratings note: “Its social media platform remains somewhat nascent, and Fitch notes potential execution risks as the company reworks content production and other operations elements to align with new platforms.”

Even in a best-case scenario where QVC successfully manages the social-commerce shift, Fitch expects revenue declines to improve toward low single digits in 2026. That is hardly enough to reverse QVC’s continued downward trajectory.

QVC seems to have lost sight of the “Quality, Value, Convenience” retail formula in a search for trendy new platforms and modern creative content. The fact is quality, value and convenience never get old in retail no matter what platform you choose.