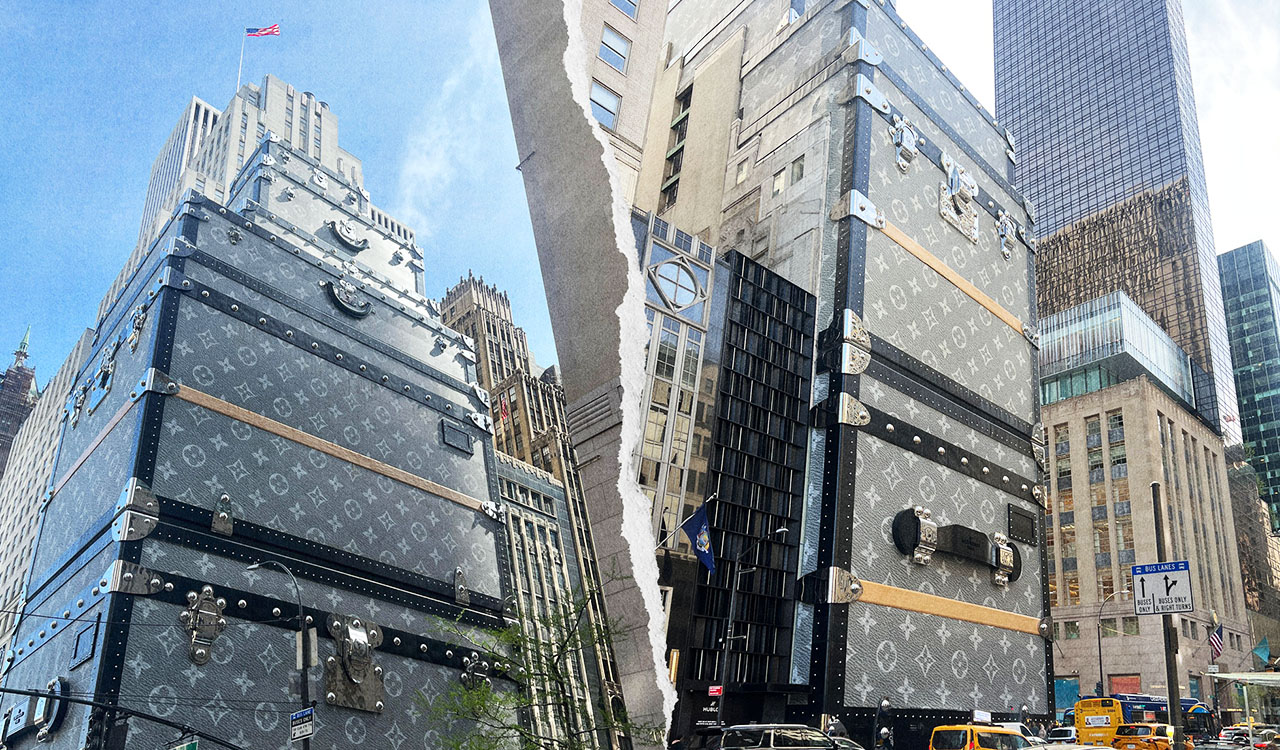

What do you do when you’re in a slump? You double down on creativity and imagination to overcome the odds with optics. Say, for example, you’ve temporarily closed one of your signature headquarters stores in New York. Or you are in the throes of building a massive new headquarters in Paris. If you are LVMH, you go all in on “notice-me” temporary building wraps that keep the vibrancy, heritage and covetousness of your products top of mind in the cultural conversation. And then you create pop-ups to fill the shopping gaps that are as memorable as the flagship stores. Sales may be down, but the originality of delivering an experience exceeds anyone’s expectations. Full disclosure: It takes deep pockets to pull any of this off.

Here’s a troubling possibility. Like Nero, is Arnault serenading investors while his Rome is aflame? Fourth-quarter results were disappointing for his luxury behemoth as were Q1 2025 and frankly, the near future doesn’t look so good either.

LVMH Breaks the Luxury Mold

Last spring we wrote about how genius LVMH was with its Summer Olympics sponsorship, maintaining and enhancing brand awareness across many of its 80 brands. Their participation was highly visible despite the slowdown in luxury spending. Their collabs of monumental proportions spanned months and traversed the entire city of Paris and most LVMH brands. The unveiling of restored Notre Dame in December 2024 provided Louis Vuitton with yet another cultural moment as Pharrell Williams performed his award-winning “Happy” at the reopening ceremony. It was Louis Vuitton, front and center. In a year when luxury has been under increased macroeconomic pressures, LVMH invested wisely to stay at the forefront of consumers’ minds.

Keeping in Touch

One differentiator of great consumer companies is consistent and relevant communication with shoppers and potential customers regardless of sales trends and economic and social headwinds. Brands want to be top of mind with their target audiences, so when their customers are ready, willing and able to spend, they will turn to the brand that engaged them through the lull. Sadly, not all leaders see the value in brand marketing during downtimes. And worse? For the enlightened leaders who do, many just don’t have the capital to invest in this branding initiative.

The leaders at LVMH take this strategy to heart. In tandem with its Q1 2025 sales call, Cecile Cabanis, CFO reminded investors when discussing Fashion & Leather Goods, “For us, it’s key to continue to invest in our networks and behind the brand because we want to make sure that we exit this downturn cycle very strong and ready when demand bounce back. So, it’s all a matter of balance between adjusting to the current context and ensuring that we keep investing in our long-term growth.”

Luxury Brand Talent

In the past 20 years, we have seen the luxury industry increase its acumen with the enlistment of the world’s best managers and graduates from CPG brand management and marketing including P&G, Unilever and PepsiCo. Coupled with that expertise is the North Star of exclusivity and scarcity that make luxury so coveted. As Richard Hayne, CEO of Urban Outfitters told me 20-some years ago, “Big is the enemy of cool.” Luxury is, after all, at the apex of desire and emotion wrapped in an irreducible product. When everyone at the airport is carrying said luggage, bag, backpack or passport holder, the apex is lowered to mainstream, and the dream is gone.

Smoke Signals

Here’s a troubling possibility. Like Nero, is Arnault serenading investors while his Rome is aflame? Fourth-quarter results were disappointing for his luxury behemoth and frankly, the near future doesn’t look so good either. Yet a handful of other luxury companies (Hermès, Brunello Cucinelli, Mytheresa, Prada, Ralph Lauren, Richemont), albeit far smaller with only a handful of brands, are reporting solid results. Is mega-luxury diversification hitting a wall?

With the hyperbole of few corporate executives, Bernaud Arnault, Chairman and CEO of LVMH, spoke glowingly of his business, brands and team on the January 28, 2025, earnings call. He said,

“So, it is a challenging environment, but Dior fared best compared to its competitors. And we’re hopeful and we’re confident. I am optimistic. We always need to be cautious, but I am confident.”

Reversal of Fortune

What a difference a quarter makes! Macro indicators of consumer health have weakened, from slowing monthly retail sales (excluding autos) and the University of Michigan’s Consumer Sentiment Index dropping to 50.8 in its most recent April 11th preliminary reading, its lowest level since June 2022 as consumers assess as best they can the possibility of tariffs, inflation and recession, global unrest and the recent stock market selloff. LVMH didn’t fare so well in the first quarter of 2025, with a 3 percent (organic) revenue decline, reflecting a 9% drop in sales of Wines & Spirits and a 5 percent decrease in Fashion & Leather Goods sales; sales in the Americas declined 3 percent as well.

A confluence of forces in 2024 stalled the luxury market sales trajectory of the past 25 years. As a global industry, luxury thrives with the many transactions normally occurring during travel. Covid played havoc with luxury demand and then the tide turned with heightened pent-up demand as consumers sought feel-good experiences to compensate for the imposed social and travel constraints. U.S. shoppers, armed with Covid relief funds accelerated the U.S. luxury market growth pace, while Europe sales stayed stalled after the drop in international travelers. The Chinese luxury shopper, which propelled luxury growth for the first 20 years of this century also stalled and in 2024, most luxury brands have explained away their weakened sales with the disengaged Chinese consumer. Japan on the other hand, with its weakened yen, is currently enjoying a surge in its domestic luxury market with an influx of international luxury shoppers lured by the attractive exchange rates.

Another factor with residual side effects is how many luxury brands increased prices during Covid at double-digit annual rates without any apparent increase in quality — because they could. In retrospect, it seems opportunistic and insensitive to hold the luxury market hostage. But it worked then as prices and sales soared. Now post-Covid, those prices have caught up with market conditions, and consumers are constrained by inflationary pressures across most consumer products and services. They are seeking value and have been more selective in their spending across staples and discretionary purchases well as luxury products and services. The luxury market is currently experiencing a period of ‘normalization.’ Chinese and Russian impact on luxury growth diminishes, and the Middle East, India and South America are stepping up. But these new growth markets will take time.

The TikTokification of Luxury

Meanwhile, the face of the luxury shopper and what attracts and retains them has changed. The luxury market is more dynamic today than ever with greater consumer brand awareness and access due to technology. The increase in provenance transparency matches the growing sentiment for individual self-expression at the expense of luxury logo branded products. To attract the next generation of luxury shoppers, luxury brands are embracing TikTok, where Louis Vuitton has 14.9 million followers and 113.9 million likes (as of April 22, 2025). Social is also where immediacy, authenticity and community thrive. Heritage storytelling, loyalty and customer lifetime value are not TikTok’s strengths. This is a younger cohort leading with new a definition of value: vintage, consignment, DUPEs, experience and authenticity.

For luxury brands, balancing fashion and timelessness, heritage and trend, exclusivity and accessibility in a 30-60-90 second video is no small feat. It may not be a race to the bottom as TRR founder Robin Lewis foresaw for retailers, but TikTok marketing is reminiscent of a hamster’s wheel spinning faster and faster but going nowhere.

Generating Desire and Demand

To further court growth and new aspirational luxury shoppers, Louis Vuitton is following other top luxury brands and entering the beauty category later this fall with the launch of La Beauté Louis Vuitton, with beauty and fashion icon Pat McGrath as creative director. Beauty is the entry point into a luxury brand for many aspirational customers; it drives store traffic and creates emotional engagement as a quick pick-me-up affordable indulgence. Beauty is a tough category, and one Louis Vuitton has long avoided. This decision suggests management sees further expansion of its iconic Neverfull and Speedy brands but risks potential overexposure and diminishing returns. Beauty is a wise choice. With the global Louis Vuitton store fleet, beauty will drive store visits and potentially increase frequency, longer queues, FOMO and increased wallet share of existing clients while attracting new aspirational luxury shoppers. Completing its comprehensive lifestyle strategy, Louis Vuitton launched a home collection of furniture, lighting, objects, textiles and tabletop in April at the Milan’ Design Week its gorgeous (no surprise here) and I could move right in (with limitless funds).

Keeping Up Appearances

With an annual advertising spend of €9.5 billion or 11.5 percent of revenues in 2023 and 2024 across its 75 Maisons, LVMH significantly outspends its competition, providing a powerful competitive advantage. Under Arnault, LVMH luxury has expanded its allure beyond quality craftsmanship to become a consummate aspirational dream maker. Its sizable marketing budget allows LVMH to spend its way out of an economic slump and stay top-of-mind with nontraditional, attention-getting optics. This year they activated a 10-year partnership with Formula 1 that will touch multiple brands, including Louis Vuitton. The bet is to reach new audiences and create unique cultural touchpoints with an alliance based on high performance, world-class design, exclusivity and mystery.

With the growth mantra Arnault lives by, an LVMH merry-go-round of new artistic directors and brand presidents is tasked with driving cultural relevancy, creating jaw-dropping retail experiences and excitement while balancing growth with enhanced brand equity. Arnault’s latest effort to prolong his CEO tenure until he hits 85 years old is on call for shareholder approval in the latest proxy. He’s busy grooming his children and other talents but is in no way ready to give up the reins.

Megabrands with the ability to spend will win. A truly unique and differentiated product is the calling card. Clever product positioning can potentially capture attention and mindshare. For luxury brands, it is increasingly difficult to develop and maintain a relationship with prospective and existing customers across all the varied consumer touchpoints. It takes deep pockets and staying power, LVMH and Arnault have both. Just look at the statement his wrapped flagship store on 57th Street makes, and you get a sense of the no-holds-barred spending power of keeping up appearances.