Holiday shopping trends 2024 are poised to be positive for retailers and brands, despite concerns about inflation and a shorter shopping season. But make no mistake, this year’s Christmas shoppers will be seeking deals before they rush home with their treasures.

Some merchants may have concerns that this year’s political climate could impact shoppers, but Attentive, an SMS marketing firm, reports 59 percent of consumers said the election won’t impact their holiday shopping plans. And 26 percent said if they got a good offer or discount, they would buy no matter the timing. WGSN says research suggests consumers pause their spending two weeks before and during the week of an election, but will spend after the election.

Shopping Calendar

Mastercard SpendingPulse expects spending will be up 3.2 percent year-over-year (YOY) this holiday season, which will be running from November 1 to December 24. Traditionally, shoppers waited until Thanksgiving to start making their holiday purchases. Hence, the importance of Black Friday. Last year, Thanksgiving was on November 23, but this year it falls on November 28, which would presumably give shoppers nearly a week less to get their shopping done. On the other hand, early shopping is becoming commonplace. To wit, Amazon rolled out its Prime Big Deal Days in early October, prompting stores from Target to Neiman Marcus to drop competing sales of their own.

Retail moves like that have helped make October a popular time for consumers to begin their holiday shopping. While about one-quarter of consumers (24 percent) plan to start their buying in November this year, that’s trailed closely by 21 percent who will start in October, according to the Cotton Incorporated 2024 Lifestyle Monitor™ Survey. October is also the most popular time (16 percent) for consumers to start researching their holiday gifts.

Let’s Make a Deal

And researching they will do, as deal-seeking is the theme this year. Among those who buy holiday gifts, more than half (55 percent) say they plan to shop online during Black Friday, according to the Monitor™ research. That’s followed by Cyber Monday (48 percent), the week leading up to Thanksgiving Day (25 percent), Thanksgiving Day (20 percent), National Free Shipping Days in mid-December (17 percent), Green Monday and Christmas Eve (both 13 percent), Labor Day/Labor Day weekend (11 percent), and after Christmas (8 percent).

While “buying on sale” is practically the default American way, WGSN advises stores to be transparent in their pricing, so as not to turn off customers.

“Commit to price transparency as shoppers become increasingly weary of price gouging,” WGSN states. “Rather than helping overcome consumer skepticism about the discounts offered, they can lead to more of it. Look to 2023’s viral TikTok hashtag #BlackFridayIsAScam. Similarly, Amazon customers found that merchants inflated their prices ahead of Black Friday 2023 to promote steeper discounts, driving down trust.”

Instead, WGSN recommends retailers have the confidence to hold off on sales until peak periods. The agency reminds last year saw some retailers begin promotional cycles in August, even though a spike in sales didn’t occur until a few days before Black Friday and Christmas. WGSN also recommends targeting promotions to the most loyal customers via holiday loyalty programs. And it suggests creating limited-time product bundles or gift sets that offer convenience and savings without sacrificing perceived value.

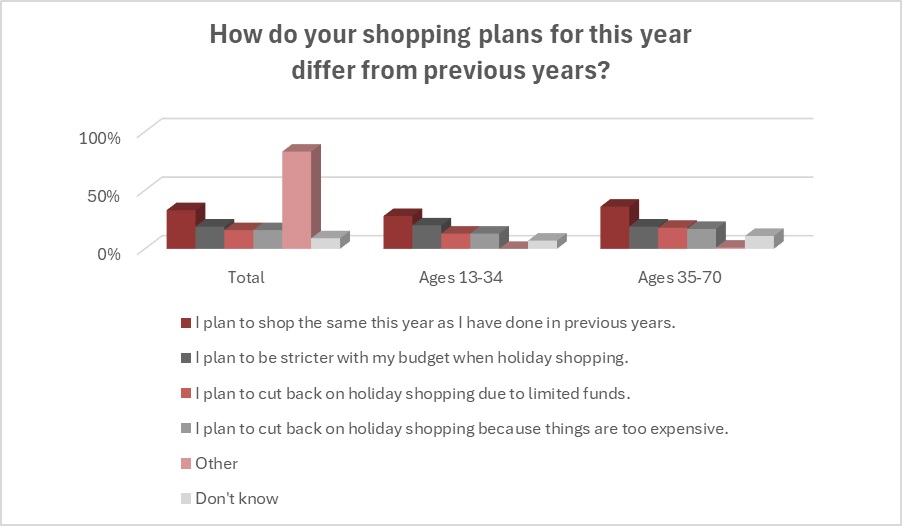

This year, one third (33 percent) of shoppers say they plan to shop the same this year as they have done in previous years, according to the Monitor™ research. Over half of consumers (51 percent) say they plan to shop differently this year by planning to be stricter with their budget (19 percent), planning got cut back on holiday shopping due to limited funds (16 percent), and planning to cut back because things are too expensive (16 percent).

Economic Flux

Among those planning to buy holiday gifts, the majority (60 percent) say the current economic situation/inflation will affect their holiday shopping, according to Monitor™ research.

These concerns persist despite economic data from the Conference Board that forecasts the U.S. GDP will expand by 2.5 percent YOY, a slowing inflation and a healthy labor market, in addition to interest rate cuts by the Fed that should continue into 2025.

Consumers expect to spend an average of $844 on all their holiday gifts this season, an 8 percent decrease from the average of $914 in 2023, according to Monitor™ research. Most of those intending to buy clothing as gifts (70 percent) say they plan to spend the same or more on apparel presents this season as last year. Shoppers plan to spend an average of $337 on apparel gifts this holiday. Male shoppers say they plan to spend an average of $390 on clothing gifts, while female consumers plan to spend an average of $293.

Mastercard SpendingPulse says shoppers “show an inclination for online apparel spending. Based on those insights, SpendingPulse expects online apparel sales to increase by 4.5 percent YOY and in-store by 2.0 percent YOY.”

Despite financial concerns, most consumers (71 percent) say they will not use store financing, layaway or buy-now-pay-later options when purchasing holiday gifts, according to Monitor™ data.

The Political Arena

Some merchants may have concerns that this year’s political climate could impact shoppers, but Attentive, an SMS marketing firm, reports 59 percent of consumers said the election won’t impact their holiday shopping plans. And 26 percent said if they got a good offer or discount, they would buy no matter the timing. WGSN says research suggests consumers pause their spending two weeks before and during the week of an election, but will spend after the election. Bread Financial, a tech-forward financial services company, also expects shoppers to home in on Black Friday discounts as election distractions dissipate.

Gift Boxes

So, what kind of apparel gifts will shoppers be looking for? The Monitor™ data shows among those who would like to receive clothing as a gift, more than half (57 percent) say they would prefer to receive T-shirts, followed by sweaters (37 percent), sleepwear like robes, pajamas and nightgowns (37 percent), jeans (36 percent), outerwear like coats, jackets and hoodies (34 percent), socks (34 percent), and casual shirts like polos and button-up styles (32 percent).

Among those planning to buy apparel as a gift, nearly 6 in 10 (57 percent) say they generally look for cotton clothing, according to the Monitor™ research. That far outpaces every other fiber including polyester (3 percent), linen (2 percent), wool and silk (both 1 percent). Consumers say they look for cotton when shopping for clothing gifts because it’s comfortable (76 percent), soft (59 percent) and it feels good (57 percent). Shoppers also say cotton is quality fabric (52 percent), it’s durable (52 percent), and it’s breathable (42 percent).

Like every holiday, the upcoming season is a lot for every retailer and brand to navigate. But as Attentive points out, “Brands that can effectively use these insights and adapt to the shifting demands will likely find themselves at a competitive advantage, capturing the hearts and wallets of the modern consumer.”