I recently returned from NRF’s 2023 “Big Show” in New York, along with nearly 40,000 of my new best friends. There were plenty of shiny new objects such as holograms, smart mirrors, the metaverse, and the like. These innovations certainly create great press, and buzz.

Not only will physical stores stay relevant, but they will also become more strategic for retail organizations when they are no longer managed as primary points of sale.

True the hundreds of keynotes, panels, and featured sessions by some of the retail industry’s most noteworthy leaders and observers and the thousands of vendors touting their tech on five massive Expo levels are both mind and foot numbing. Also true, although this year’s discussions spanned the economy, supply chain, web3, personalization, re-commerce, retail media networks, security, direct-to-consumer brands, and the tech-enabled consumer. For me, truly sustainable retail brands and retailers will be digging into the more impactful and enduring trends. The most interesting, and thought-provoking discussions filled four buckets:

- Redefining the store’s purpose

- The importance of a brand’s culture and authenticity

- The changing role of frontline retail worker

- The overriding importance of unified commerce (omnichannel is so yesterday).

Rethinking the Physical Store

“The Store of the Future is Less About the Store and More About the Business Model,” while a mouthful, was a presentation that got my attention. The subtext of the conversation was that not only will physical stores stay relevant, but they will also become more strategic for retail organizations when they are no longer managed as primary points of sale. The international speakers included Roberto Funari, CEO of the multi-billion-dollar Brazilian footwear manufacturer Alpargatas (Havaianas & Rothy’s); Giorgio Pradi President Sunglass Hut NA; and Alberto Serrentino, Founder Varese Retail, a retail strategy and digital transformation group based in Brazil.

Pradi spoke about the dramatic shift of the digitally based consumer and how it is altering the very nature of the in-store experience. He emphasized the importance of the brand “knowing the customer” literally, to enable productive and highly personal store engagement. This mega shift in the customer’s mindset was fostered during the pandemic, and its long-range implications are only now beginning to be addressed.

Serrentino distilled the fundamental drivers behind rethinking the physical store. In a post-pandemic world, the convergence of higher digital penetration, new and different journeys, less foot traffic, and more omnichannel transactions have coalesced to force a complete store portfolio review. That review will impact the sizes, placement, and number of store units like never before. The new mantra appears to be “in a digitally engaged ecosystem, the physical store is more important than before.” Integration is everything with the customer journey.

Serrentino validated Target’s “The Store as A Hub” theory, with four quadrants feeding the hub. These include customer acquisition and engagement; logistics, service, and omnichannel. The new org-graph also drives new KPIs fed by data capture and analysis. Age-old dollar per-square-foot metrics give way to five new metrics: customer base, customer acquisition costs (CAC), customer lifetime value (CLV), net promoter score (NPS), and omnichannel transactions.

Authenticity in Sustaining Brands

Richard Dickson, President, and Chief Operating Officer of Mattel and Shopify President Harley Finkelstein talked culture. Dickson noted that Mattel started in a small garage in 1945 as “Mattel Creations.” It now owns 400 of the most coveted toy brands with a market cap of over $7 billion.

Dickson highlighted four major drivers behind the enduring brand: purposeful play, design-led innovation, cultural relevance, and executional excellence. These core standards connect their business and consumers in authentic ways. He said that authenticity is everything — as is attention to detail. These mandates drive Mattel to go the distance when it comes to new toy introductions.

For example, Mattel’s model shop practices best-in-class execution. Not unlike the automotive companies, a full scale-model of each new Hot Wheels vehicle is produced in order to get the smallest details right. Since their introduction in 1968 over four billion Hot Wheels have been produced, the rarest of which have traded hands in the thousands of dollars.

Dickerson discussed the importance of storytelling in both achieving and retaining high brand value. The immersive experience of visiting an American Girl Store becomes transformational for many families. From the café where the dolls are luncheon guests along with their young parents, to the hospital where a child’s cherished doll goes for restoration and repair, deeply understanding the American Girl customer informs the experience.

In a little-known behind the scenes anecdote, Dickerson revealed that when it comes to entrusting a child’s treasured friend to “toy surgeons,” kids often take elaborate measures to discreetly mark their dolls. The doctors are trained to be on high alert for tiny markings to make sure that personal identifiers remain intact when the doll arrives back at the child’s home from the hospital.

Cultural Cues

The NRF Visionary 2023 Award winner Marvin Ellison, CEO of Lowe’s, discussed the importance of culture, authenticity, and diversity with NRF CEO, Matt Shay. Ellison’s extraordinary career and his ongoing role in the revitalization of Lowe’s is legendary. Ellison noted that he began his career as a $4.35 per hour Target employee and worked every retail job en route to leading a Fortune 500 retail company. He was candid that as an African American, throughout his career he often didn’t look like anyone else in comparable roles. He credited his “against the odds” corporate climb to his willingness to take tough jobs nobody wanted and working hard to succeed. Poignantly he noted that when people see a “turtle on top of a fence post” they know it didn’t get there by accident.

Ellison noted that when he set out to activate Lowe’s transformational “Total Home Strategy,” he knew many personnel changes would be required. He stated, “Lowe’s had a diversity problem,” and to create the kind of corporate and employee diversity to reflect Lowe’s customers, changes were in order. He said Lowe’s fosters action, courage, focus, and accountability among its workforce. He personally believes in the role model mantra of “servant leadership,” lifting people up to become the best versions of themselves. He clearly walks his talk; when he arrived at Lowe’s, rather than immediately moving into the C-suite, he chose to be assigned as a Lowe’s sales associate. That speaks volumes about character.

Ellison believes that the physical store is central to the retail strategy. But he also understands that “convenience without friction” requires a highly connected unified commerce system, to create a sustainable, successful retail brand. Above all, he knows that diversity is strength. “Our Team members live and work in the communities that our stores are in, and it’s only natural that our customers expect that our associates are a reflection of their community.”

Dynamic Frontline Workforce

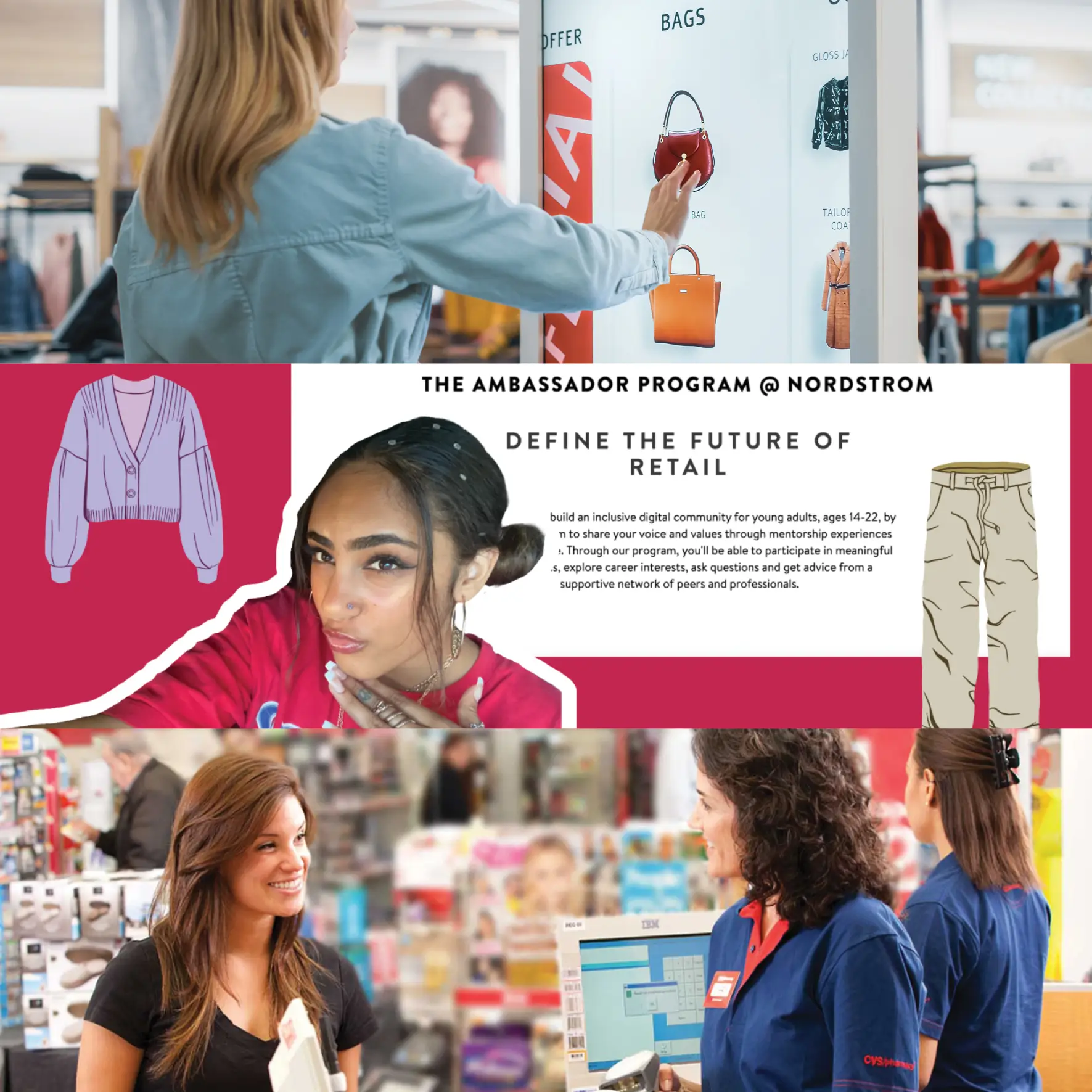

Retailers are reinventing how they recruit, train, motivate, and empower staff as new retail models emerge and staff roles change from being purely transactional to becoming relationship builders and brand ambassadors. I’ve been writing on the topic for well over a decade. “Retailing’s New Truths” written eight years ago concludes with the concept, “From Clerk to Brand Ambassador.” Pradi spoke at length about their newest initiatives in their 3,200+ stores, and the massive investments being made creating authentic “brand ambassadors” to properly integrate core brand attributes throughout the customer journey.

“Building and Sustaining a Dynamic Frontline Workforce” was led by influencer Ron Thurston. He discussed new employee empowerment models with Jessica Cloutier, Senior Director of Styling at Nordstrom; Reece G. Roberson VP, Human Resources Business Partner, at Lowe’s; and Marie Ford VP Customer Experience & Front Store Innovation at CVS Health.

Cloutier noted that Nordstrom is focused on creating career paths for their “style ambassadors.” They recognize the value of investing in their personnel to recognize what great service looks like. She emphasized that since “great service looks different all of the time,” it’s important to understand that the customer values flexibility. This often requires a team member to know how to pivot.

Because Nordstrom understands that the customer journey must be on shoppers’ terms, they are making investments in providing brand ambassadors with mobile-optimized devices to better serve shoppers. These digital aids also promote valuable endless aisle merchandising options, which when combined with Nordstrom’s commission policy yields great returns as well as associate loyalty. It has all the earmarks of creating a true “clienteling” relationship, which I’ve long advocated for.

Ford added their company is making strides in helping employees develop and “visualize” a career path within CVS. They are assigning employees with both mentors and sponsors, which play key roles in career path success. CVS has learned that to develop committed and engaged employees they must create a sense of belonging by uniting associates with likeminded people.

Unified Commerce

The ubiquity of the Unified Commerce theme is undeniable; the buzzword du jour is “phygital.” Channel unity has certainly been much discussed pre-Covid, however the behavioral changes resulting from our many months “hunkering down” resulted in a “fast-forwarding” of channel unification.

Regrettably, legacy retail has had a “channel fixation” for over two decades at their own peril. The siloed industry has evolved from single-channel to multi-channel, to cross-channel and now omnichannel. The channel terminology doesn’t recognize that the customer doesn’t think about channels, just the shopping experience. And that experience is completely dynamic, highly personal and ever more fluid.