Consumer Facts from Cotton Incorporated Lifestyle Monitor™

A year ago the rising costs of materials, labor and fuel put pressure on apparel brands and manufacturers to maintain margins and pass minimal costs onto the consumer. In re-thinking sourcing strategies, many brands sought to cut corners by substituting cotton with synthetic fibers. Cotton, a mainstay of apparel, had historically high prices last year. One year later, the landscape is different and so is the consumer perception of quality; begging the question, is there a higher cost for diluting the touch and feel of cotton?

The run-up in cotton fiber prices a year ago was mistaken by some as the sole reason for increased apparel costs at retail. Indeed, the jump to $2.43 a pound on the A Index was unprecedented. However, other factors, such as: increased labor costs in textile manufacturing regions; increased fuel costs; the increased price of fibers competitive to cotton; and a 15-year cycle of deflationary apparel pricing in the U.S. all played a part in the slightly elevated prices consumers are seeing at retail. At the retail level, apparel prices increased year-over-year 4.2% in February, the most recent data available. Interestingly, although apparel prices have increased over the last few months, consumer demand for apparel has shown signs of resiliency. In January, when prices were higher than in February, the U.S. Department of Commerce reported consumer apparel spending was stable on a price adjusted basis relative to a year prior.

Cotton fiber prices have also stabilized, which could lessen some pressure on margins and retail prices. New York cotton futures have been trading at levels between 85 and 95 cents per pound, down from the A Index world value highs of $2.43. An increased supply of cotton on the market may further ease, or at least maintain stability of, the price of cotton fiber.

“The peak in last year’s prices coincided with the time period when farmers were deciding what crops to plant,” says Jon Devine, lead economist for Cotton Incorporated. “As a result, farmers planted a record amount of cotton for the current crop year, and a record cotton harvest is forecast. The high prices, though, led to some declines in world cotton consumption, and this cycle ensures that fiber supplies will be relatively plentiful.”

While cotton economics adjust to supply and demand updates, consumers are still feeling a pinch at retail counters. Among those who have purchased apparel in the past six months, nearly seven out of 10 say prices increased from last year, the Cotton Incorporated Lifestyle Monitor™ Survey shows. And, while the U.S. economy continues to expand – adding 227,000 jobs in February, and pointing to a positive outlook for the remainder of 2012 – consumers are less optimistic about their personal economic situation.

“Higher price tags are still a concern,” says Kim Kitchings, Vice President, Corporate Strategy & Program Metrics. “Consumers are coping with increased costs for household goods, and most feel fairly pessimistic about their personal finances. We saw a decline in the percentage of those who feel very or somewhat optimistic about their personal economic situation – from 50% in 2010 to 46% in 2011– and that can certainly affect their shopping habits.”

Those consumers who are shopping for new apparel also seem concerned about the quality of their purchases. Fifty-four percent noted that many of the clothes that used to be made from cotton now seem to be made from other fibers, indicating that they are aware of fiber substitutions by some manufacturers.

In denim jeans, perhaps the most iconic item of cotton apparel, some manufacturers have added as much as 15% to 30% polyester in an effort to keep costs down, in a move that saves from 15 to 20 cents per jean in production. While this may have been a necessary experiment when cotton fiber was more than $2.00 a pound, is it a false economy now that cotton is trading for less than $1.00 per pound? The answer lies in consumer perception and their willingness to purchase “diluted” denim.

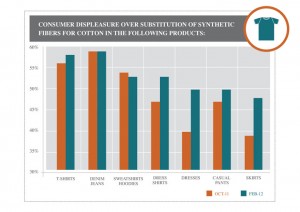

“Responses to Lifestyle Monitor™ survey questions show that 75% of consumers say cotton and cotton blends are their favorite fibers to wear,” says Kitchings. The survey further reveals that nearly 6 out of 10 consumers are bothered that brands and retailers may be substituting synthetic fibers for cotton in their T-shirts (58%) and jeans (58%), followed by sweatshirts/hoodies (52%) and dress shirts (52%). Compared to a few months ago, significantly more female consumers are bothered that brands and retailers may be substituting synthetic fibers for cotton in their dress shirts (46% to 52%), dresses (39% to 49%), and skirts (38% to 47%).

“Consumers are noticing the difference cotton substitutions make in the look, feel, and durability of their clothing, and these tactile characteristics affect their perceptions of quality for garments and the brands that sell them,” says Kitchings.

Quality is of key concern to recession battered consumers, evidenced by the fact that 73% of respondents tell the Monitor survey that they expect to wear clothing longer, and 58% currently define “quality” as “durable” or “long-lasting.” The survey also reveals that 62% of consumers agree that cotton clothing is higher in quality than synthetics.

The association of cotton with quality, and the importance of quality to post recession consumers, is borne out in their willingness to pay more for cotton apparel. In spite of pessimism about their personal financial situations, more than 6 out of 10 consumers (63%) say they would prefer to pay a slightly higher price to keep cotton from being substituted with synthetic fibers in their jeans. The sentiment follows for other cotton apparel items: T-shirts (58%), dress shirts (52%), and sweatshirts/ hoodies (50%).

“Over the past few months, the number of respondents willing to pay more to keep cotton in their apparel has increased an average of 5 percentage points across apparel categories, with dresses highest at 10 percentage points,” says Kitchings.

The textile supply chain is undeniably complex, with a range of businesses fulfilling specific functions, and a multitude of factors affecting each link on the chain. The collective effort, however, is simple: give the people what they want. Cotton prices are stable and supplies forecast as ample; consumers have a heightened sense of quality, which they associate with cotton and cotton-rich apparel. In the current climate, substituting synthetics for cotton may save a few cents per unit, but at the expense of diluting brand perception in a highly competitive marketplace.

Is it worth it?